IMO 2020 to Cause Market Chaos: Verleger

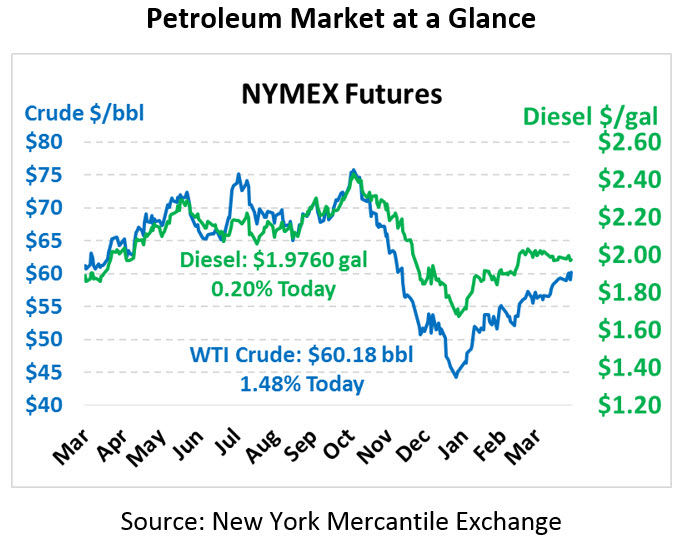

After a downward hiccup yesterday morning, oil prices regained most of their losses by closing time. Today prices are rapidly pushing higher, once more above $60/bbl. WTI Crude is currently trading at $60.18, up 88 cents (1.5%).

Fuel prices are up as well, though with weaker gains. Diesel prices are currently $1.9760, up 0.4 cents (0.2%). Gasoline prices are $1.9010, up 2.1 cents (1.1%).

Today’s strong rally comes as Russian data suggests the country has achieved its production quota for March, producing 11.3 MMbpd on average. Russian oil minister Novak noted his country supported Saudi Arabia’s proposal for a three month extension of cuts, though hinting that anything longer may face pressure from domestic oil producers. Russia and Saudi Arabia have emerged as the two dominant voices in the OPEC+ arrangement, so support from both countries will go a long way to ensuring the cuts materialize.

IMO 2020 to Cause “Chaos” – Verleger

The countdown to January 1, 2020 continues, when all marine vessels around the world will be required to switch to low sulfur fuels. This week, prominent oil economist Philip Verleger, who last year predicted that IMO 2020 would send oil prices as high as $200/bbl, wrote an article criticizing the conservative approach some agencies and analysts have taken towards the event. He cites the President’s Council of Economic Advisors, who warn that IMO 2020 could cause up to a half million barrel per day shortage of diesel fuels.

Verleger wrote recently that the affects could be so dire that the US might choose to reinstate oil export bans, mitigating the worst impacts locally while causing severe shortages internationally. He also points out that the IMO’s projections of suppliers’ ability to meet demand is based on faulty assumptions of 12-13 MMbpd production in Saudi Arabia (currently closer to 10 MMbpd because of OPEC cuts) and 4 MMbpd production in Venezuela (currently less than 1 MMbpd).

Southwest Fuel Supplies Tighten

Looking locally, refined products in the Southwest have grown quite tight in recent weeks, especially in the Arizona, New Mexico and Southern California regions. In part, the tightness stems from the on-going supply issues in West Texas, where explosive Permian drilling has been consuming more fuel than can be shipped from Gulf Coast refineries. A refinery in West Texas has also had recurring operational issues that have affected 200 kbpd of supply. That leaves less fuel available to flow on to AZ, forcing suppliers to pull more from Southern California.

Refined product pipelines running from LA are at maximum capacity, and pipeline maintenance and summer-to-winter gasoline conversions affected deliveries from that direction earlier in March. Several terminal and retail locations have experienced shortages over the past week.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.