Week in Review

This week was largely uneventful for prices – while more details were provided on OPEC’s 2019 supply cuts, “new news” was lacking. Oil remained locked in the $51-52 range, while fuel prices hovered within 5-cent ranges.

Although the week lacked any fundamental changes, it did bring three separate reports from major energy agencies – the EIA, IEA, and OPEC. Although the three didn’t present any wildly different views for 2019, they did differ on their view of supply/demand balance.

After OPEC’s commitment to cut output by 1.2 MMbpd, the IEA changed its 2019 forecast to show net global oil draws by Q2 of 2019. In contrast, the EIA and OPEC do not foresee markets tilting from oversupplied to undersupplied until Q4 2019. In part, the variance is attributable to expectations on compliance – the EIA expects only 75% compliance with the deal, while the IEA is expecting 100% compliance.

Prices in Review

Crude prices saw only mild changes this week, opening at $52.03 and rarely straying more than a dollar higher or lower than that level. A midweek rally to $53 was shot down on Monday. Friday’s opening price of $52.83 represents just an 80 cent price movement, with even those gains in jeopardy this morning.

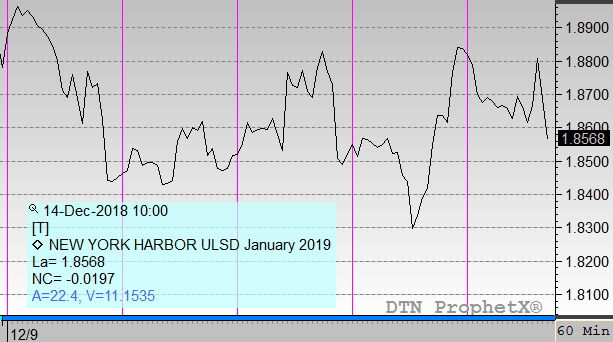

Diesel prices saw little variability as well, staying within a few cents of the opening price of $1.8786. Although intraday volatility brought a bit more variety, prices generally staid between $1.84 and $1.88. Opening at $1.8838 this morning, diesel gained just half a cent, which has been more than wiped out this morning.

Gasoline eked out slightly larger gains than diesel, but is also seeing outsized losses this morning. Gas opened the week at $1.4640, but quickly fell to just $1.41 on Monday. Prices were up and down all week – much more volatile than diesel or crude prices. Thursday brought a full 8-cent range in trading levels, sustaining over 5-cent gains relative to Wednesday. Prices opened at $1.4801 this morning, a gain of 1.6 cents, though those gains have since turned to losses.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.