IEA: Oil Supplies Tightening in Q2

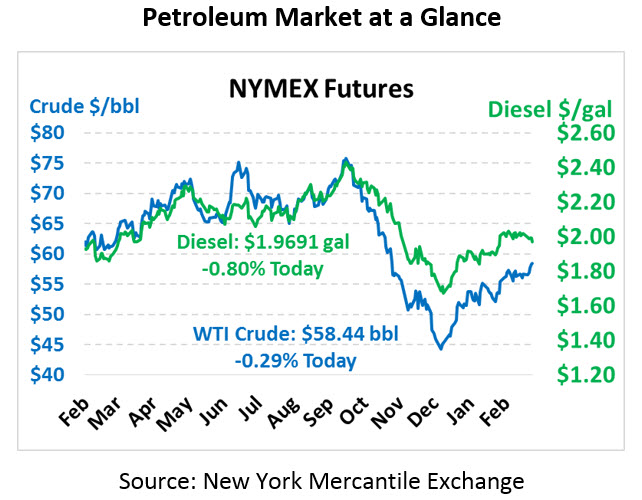

Oil prices are trending a bit lower than yesterday’s lofty closing price, though early morning losses have largely been trimmed to just small declines. Crude oil is currently trading at $58.44, down 17 cents from Thursday’s close.

Fuel prices are also lower, with diesel leading the declines. Diesel prices are currently trading at $1.9691, down 1.6 cents from Thursday’s close. Gasoline prices are $1.8438, down just 0.4 cents.

The IEA released their monthly oil report, which shows a strong turn towards undersupply in the market over the coming quarter. In fact, demand is expected to outpace supply to the tune of half a million barrels per day due to OPEC cuts and large outages in Iran and Venezuela. Despite the shortage, though, the IEA believes global spare capacity is sufficient to quickly right any surprise outages. This means that OPEC has significant discretionary power over markets – if something goes awry, they can quickly increase their output, but otherwise they will keep production low to influence prices higher.

Exxon Mobil this week announced at CERAWeek their intentions to drive Permian production costs down to $15/bbl by leveraging huge scale in the area. Permian production is already 4 MMbpd, and Exxon alone expects to produce 1 MMbpd in the region by 2024. With massive scale and 55 rigs deployed just this year, the company can spread out its costs such that Permian production will be competitive with even the cheapest international competitors. Still, not all producers can achieve this “Scale Revolution” – many smaller producers are burning through cash flow to continually reinvest in new wells, making them financially unattractive to investors and ultimately leading to higher break evens.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.