IEA Forecasts 10-Yr High Inventory Draws in Q3

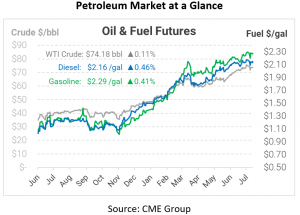

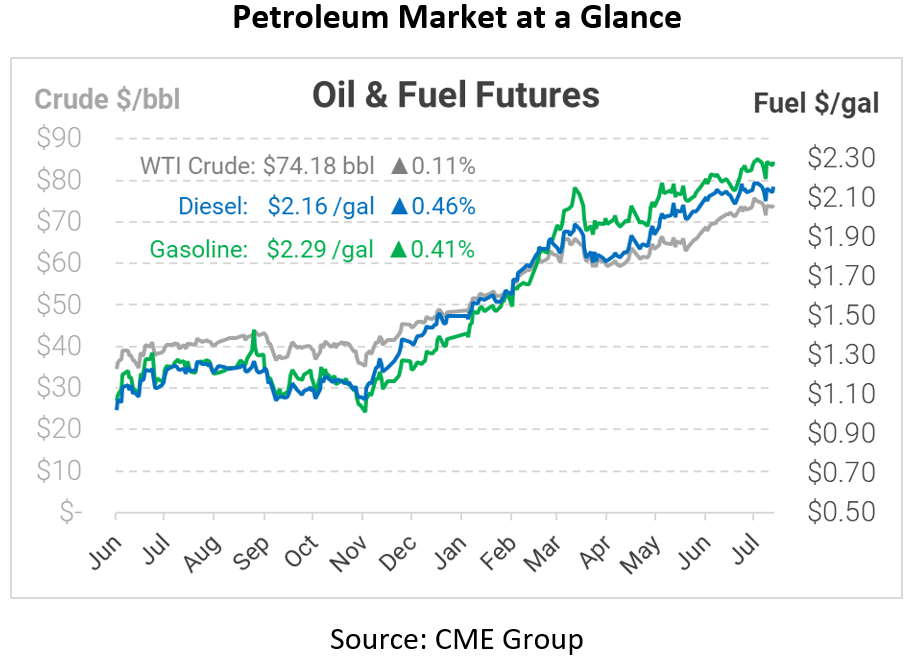

Oil prices are hovering in the low $74 range this morning, not far from their pre-July 4th peak. The International Energy Agency (IEA) released their monthly oil market report, which noted several bullish trends in the short-term. Oil demand rose by 3.2 MMbpd in June, representing a 3.4% increase month-over-month. Moreover, last month’s demand gains represent more than half of the 5.4 MMbpd increase expected in 2021. Of course, Delta-variant COVID cases are an important risk factor, which could threaten future demand.

The IEA’s report also yielded details on supply/demand balance. With demand increasing and OPEC+ still at an impasse, the IEA is calling for the largest quarterly crude draw in over a decade in Q3 if the current trends continue. Global inventories are already below their pre-COVID averages, propelling prices higher. While demand was 96.8 MMbpd in June, supply was just 95.6 MMbpd, leaving a 1.2 MMbpd gap. Over time, the notable imbalance has drawn down global inventories, with developed OECD economies reporting a 21.8-million-barrel draw in June.

Finally, the IEA notes that rising oil prices may help accelerate the push to electrify the transportation supply chain. Although there’s been a large push for added sustainability world-wide, most companies make their decisions based on economic value. As oil prices rise, alternative energy sources become more competitive, enabling companies to justify transitioning energy sources while generating a positive (or at least neutral) return on investment. Of course, the flip side is that energy transitions would reduce fuel demand, causing prices to fall once again and disrupting ROI calculations.

This article is part of Daily Market News & Insights

Tagged: Delta, electric vehicles, IEA, Oil price

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.