Iran and Venezuela Team Up on Oil – What’s the Impact?

This month, Iran is set to ship 4 million barrels of heavy crude oil to Venezuela, according to a Reuters report. Venezuela has been behind on its oil production, which in June was at its lowest level since October 2020. In June 2022, Venezuelan oil production was at about 727 thousand barrels per day (kbpd) on average. For perspective, Venezuela was producing about 100 kbpd more in December 2021. What caused this significant decrease, and what impact will these Iranian shipments have on global oil prices?

The once leading oil-producing country has seen many refineries shut down over the past few years due to various equipment failures and a lack of crude to process. Combined with a history of poor management of the country’s oil industry, Venezuelan oil production is damaged and will need a lot of assistance to help it get back to previous production rates.

In addition to the struggling oil industry, Venezuela has sanctions that were put into place by the US in 2017. These sanctions were put into place after it was found that Venezuelan citizens were suffering from food shortages, lack of basic necessities, and inflation under the presidency of Nicolas Maduro. These sanctions prevent the enabling of the Maduro regime’s criminal activity and human rights abuses. In 2019, the U.S also issued sanctions on PDVSA, Venezuela’s state-run oil company. In addition, Iran also has sanctions that have been imposed by the US and other countries due to its nuclear program.

In the past few years, the two U.S.-sanctioned countries have cooperated together, with Venezuela swapping out their heavy crude oil for Iran’s gasoline, condensate, and refinery parts. In addition, both countries struck a contract to improve the Venezuelan El Palito refinery, which encountered many incidents over the past few years, with Iran’s supply of refinery parts. In May 2022, Iran shipped 1.07 million barrels of heavy crude to PDVSA. This month, PDVSA is set to receive 4 million barrels of heavy crude from Iran. PDVSA is going to refine the Iranian crude at facilities in order to increase the output of motor fuels, which will allow them to release their lighter crudes for blending and exporting. The Iranian oil is also expected to help PDVSA recover stock of the exportable grade of fuel, Merey, which is desired by many Asian refiners. In addition, Iran will also send Venezuela 2 million barrels per month of Iranian condensate, which will assist Venezuela in increasing its output of exportable fuel blends.

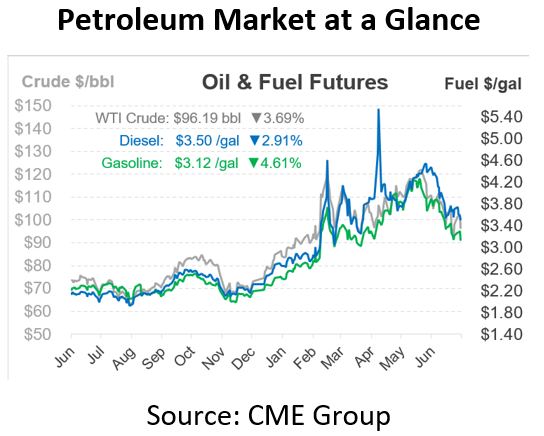

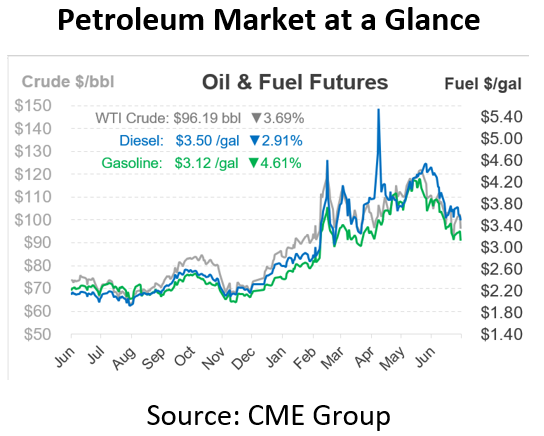

What impact will this deal have on the US? Last week, headlines stated that Venezuela resumed exporting small oil amounts to Europe, as oil companies around the world increase production in response to a spike in oil prices caused by the war in Ukraine. By importing Venezuelan oil, Europe does not have to buy American oil, which leaves more oil in the US resulting in a decrease in fuel prices. While Venezuela may not return to its 2014 oil production levels in the foreseeable future, this Iranian deal will help them slightly. As far as consumers are concerned, they may not see much price change with the current volatile market and price swings, but this is at least a step towards improving supply balances globally.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.