How A Strategic Reserve Release Affects Prices

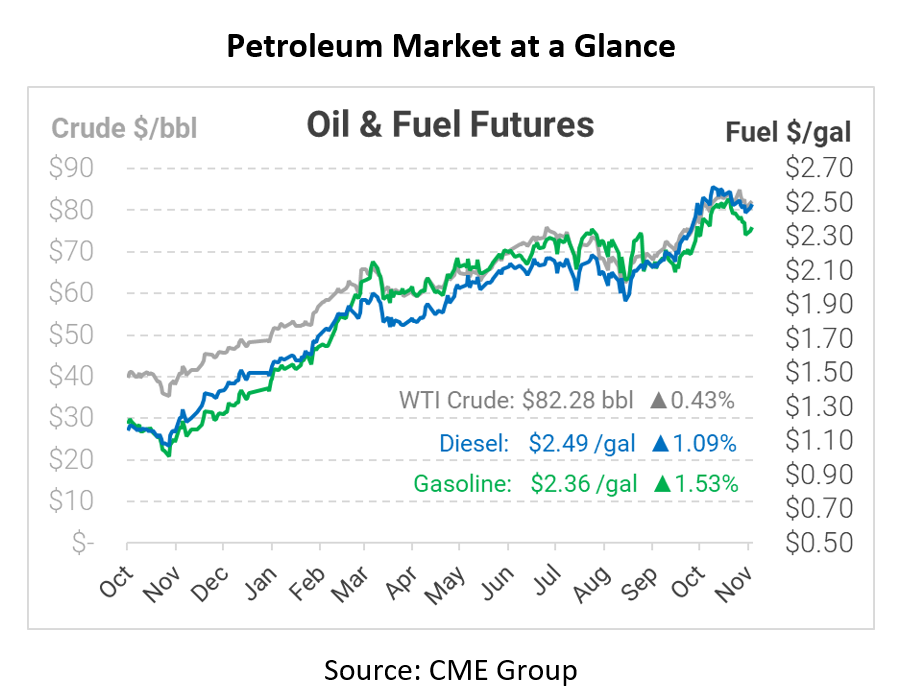

This morning, oil prices rose nearing $84 a barrel in response to the United States lifting some travel restrictions as the economy continues to recover, all while supply remains tight. Today crude oil opened at $82.16, diesel at $2.4740, and gasoline at $2.3295. As reported yesterday, the White House continues to monitor the situation with rising prices in the country as it becomes more severe. Within all of their potential policies to reduce the price of gasoline, the one that stands out is the ability for the administration to tap into the U.S. Strategic Petroleum Reserve, but how does this affect prices?

Rising oil prices and the conversations world powers are having with OPEC have reached a new level. Senior officials in the United States government are now blaming rising inflation, and global economic recovery pauses on OPEC and their refusal to increase output. With the rising concern over what OPEC will not do to help supply and demand, the United States is now seriously considering releasing petroleum from the strategic reserves. When looking at how this will affect market prices, there would likely be only short-term effects. This is because the volume of extra oil released from the reserves made available to consumers would be too small.

The strategic reserves were created in response to the Arab Oil Embargo of 1973/1974 and were built to hold up to 1 billion barrels of petroleum. While many emergency conditions grant the president the power to release oil from the reserves, it must be done meticulously. Today, if the Biden administration were to release 30 million barrels from the reserves, it would only equate to increasing global demand by 82,000 barrels per day (bpd) to the market for one year. The insignificance of a release of 30-60 million barrels shows that regardless of a possible release issued by the government, the price impact would be minimal in relative comparison to an increase by OPEC.

There are both political and practical effects of the ongoing situation in the White House regarding oil prices. On the one hand, the Biden administration wants to deal with their political cards properly to avoid facing any backlash in the future. On the other hand, the administration wants to make sure they can impact lowering the price of oil, but how they will do it will remain the question everyone wants answered. It seems clear that for the Biden White House to see an immediate lowering of oil prices, they would need not only to increase U.S. oil output but persuade members of OPEC+ to raise their production faster at the same time.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.