Global Diesel Shortage – Could It Happen?

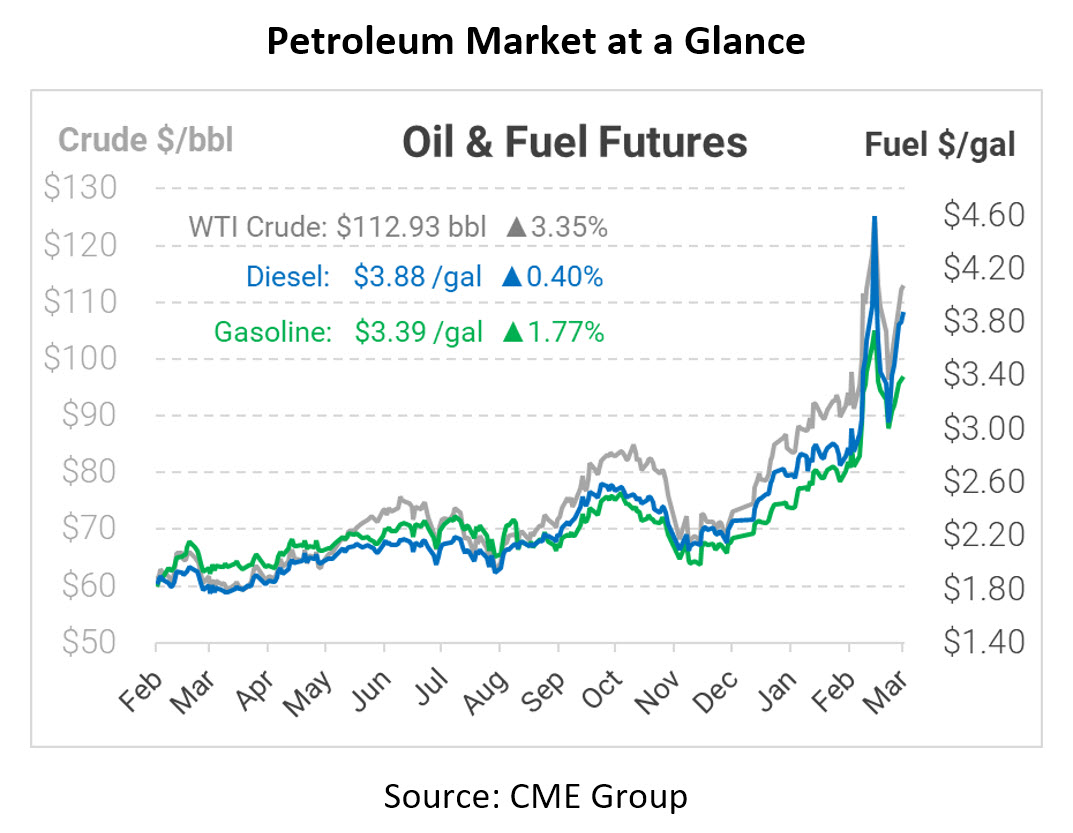

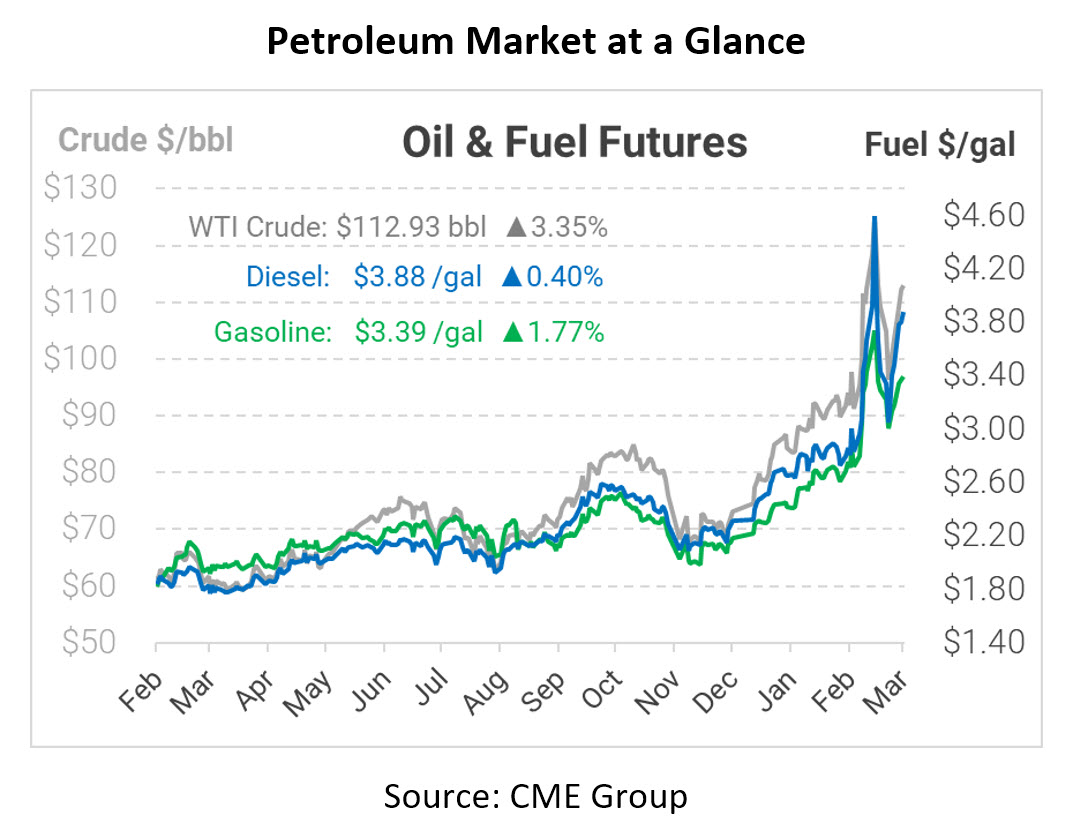

Oil prices are rising on reported damage to the Caspian Pipeline Consortium (CPC), impacting Russian and Kazakh oil exports. Stormy weather in the Caspian Sea damaged the pipeline, which pumps out 1.2 million barrels per day (bpd) to the Black Sea for global distribution. Repairs are expected to take over a month. Approximately 85% of the oil moved on the pipeline is from Kazakhstan, which produces around 1.5-1.7 million barrels per day. The outage comes as Libya struggles with its output and the world shuns Russian oil. The news adds to concerns of an impending global oil shortage.

On Tuesday, the world’s top energy traders warned that the world could see massive gas and diesel shortages due to the long-lasting effects of Russian sanctions. Executives making up the four largest energy traders in the world in Vitol, Gunvor, Mercuria, and Trafigura said that the natural gas market has become tough to manage due to margin calls. Given extreme volatility, traders are being required to post far more margin to trade oil – functionally meaning it costs more to play in the oil trading game. The changes are chewing through companies’ capital, putting financial stress on traders and speculators.

According to Vitol CEO Russell Hardy, the longer the war continues to rage on in the East, the higher the chance of economic recession. With over 2 MMbpd of oil per day in losses from the sanctions imposed on Russia, the world is trying to find other methods to absorb these massive losses. Now, diesel supplies are under particularly heavy threat. Russia accounts for 20% of Europe’s diesel fuel imports, and much more of Russia’s crude oil is refined in European refineries. Traders expect an acute shortage – possibly leading to fuel rationing in the future.

Not all hope is lost, but relief will not be immediate. With a potential signed Iranian nuclear deal, Iran could increase their exports by around 1 MMbpd. Slow and steady OPEC increases will help in the future, and traders expect a cumulative 1-2 MMbpd added to supplies assuming Iran, OPEC+, US producers, and more move as hoped. Those increases will take months, though, meaning people will be dealing with higher prices at least into the summer months.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.