Fuel Pullback Creates Budget Fixing Opportunity

While the oil rally suffered a serious setback last week, major banks are not convinced that prices are done rising. Goldman Sachs sees last week’s pullback as a blip on an otherwise steady march towards $80/bbl this summer. What’s notable about Goldman’s forecast is that their estimates for OPEC and Iranian production exceeds official forecasts from OPEC and the IEA. Even with rapidly expanding global supply, a swell of pent up demand will create supply shortages that push fuel prices higher. Other banks have echoed the call, including JPMorgan Chase and UBS Group AG.

Demand is helping to give markets confidence in its rally. Airports are seeing passengers rates climb; in the US, over a million passengers travelled each day for an eight-day streak. Global oil demand is reportedly at 95% of its pre-COVID level. Around the world, 448 million vaccine doses (5.8 out of every 100 people) have been delivered, although rates vary widely from country to country.

With fuel prices nearly 14 cents below their recent peaks, consumers are taking advantage of last week’s pullback to lock in their fuel prices for the remainder of 2021. Given rising demand – augmented by a historic $1.9 trillion in stimulus spending – the economic outlook seems strong. Many companies are gearing up for growth – whether that be increasing hiring or investing capital to take advantage of rising demand. For companies that cannot recoup higher fuel prices with additional revenue, now may be a valuable time to research fixed price fuel and other risk management tools that can prevent a blown budget.

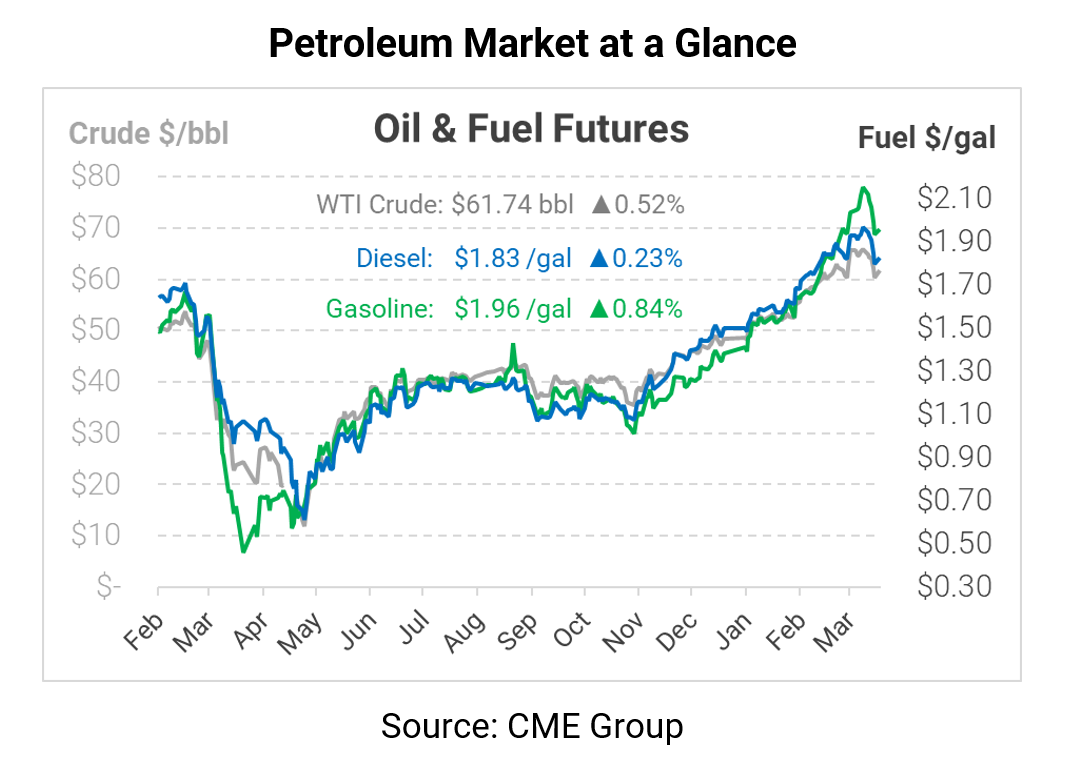

Today’s Market Prices

Oil prices are generally flat/higher this morning, with little news to spur a broad change in either direction. Crude oil is trading flat with last week’s closing price, with crude oil currently up 32 cents to trade at $61.74.

Fuel prices are moving a bit higher, with gasoline leading the way. Gasoline is trading at $1.9594, up 1.6 cents from Friday’s closing price. Diesel is trading at $1.8265, up 0.4 cents.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.