Fuel Market Perspectives – Guest Article by Andy Milton

What a difference a month makes.

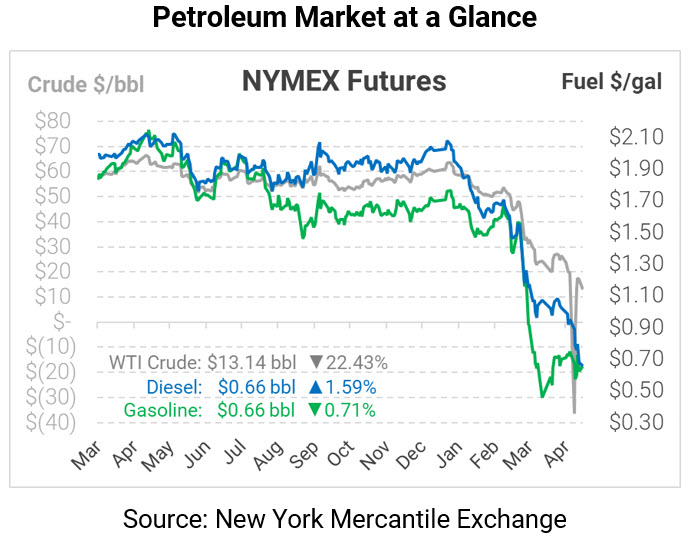

This time last month, prompt RB (gasoline) was trading 60cpg cheaper than HO (diesel). On Friday, HO ended lower. Although HO is a bit higher today, Friday’s flip was significant for several reasons:

- Market chatter points toward demand having found a bottom and started a recovery. Albeit, a bottom would be early, but even a rumor is all folks need to perceive things are improving.

- Typically this time of year, RBOB would be taking the price lead vs. HO, so the recent flip suggests some semblance of normalcy is returning to markets. Expect higher RBOB prices to become more common, providing we don’t get any setbacks.

- The two-week trend of large distillate inventory reports has been a major factor of this collapse. While diesel stocks were trading below the five-year range just a few weeks ago, they’ve now leaped up to the 5-year average. Further builds could bring diesel inventories to the same record high levels gasoline has been experiencing. Each week’s DOE report should be closely monitored.

A few other interesting trends to watch will be the 3-2-1 Crack Spread and June WTI Crude values. Many still fear tight crude oil storage capacity will cause another round of craziness when the June 2020 contract expires. Some have called for oil prices to sink to -$100/bbl, while others say that ETFs have learned their lessons and will clear out of the contract well ahead of the expiration week. We’ll find out who’s right soon enough.

As early as last week, we had another major refiner shut its crude distillation unit. This is an indication that even as things may be improving a bit demand-wise, there’s a lack of confidence that the refined products supply overhang situation will improve in the short-term.

All that being said, even with RB/HO starting to resemble normal times, lower market prices may be here to stay for a bit.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.