Financial Market Volatility Spills into Oil

Oil prices experienced some dramatic swings yesterday, soaring to multi-year highs before plummeting to multi-week lows. WTI crude spanned a $3 range, and fuel prices fluctuated in an 6-cent range before settling near the previous day’s closing price. Although those ranges are not abnormal, the rapid changes from high to low and back to middle brought extra attention to the range. Markets are growing increasingly fearful of inflation from all the money printed by the Fed, which drove volatility for financial markets.

Easing those concerns, the Federal Reserve chairman announced that the Fed is closely monitoring the situation and will keep interest rates low to induce continued economic growth. His statement helped cool the market off, ultimately undoing much of the losses.

The API’s inventory report released yesterday helped curb losses from early in the session, but it also left traders a bit unsure. Crude production plummeted, with some agencies estimating the total production loss to be 50 million barrels overall. At the same time, refineries lowered their output. The net result should be huge draws for fuel inventories and moderate draws for crude inventories. The EIA will release their weekly report later this morning, which should provide additional context for the market. OPIS noted this morning that the Texas freeze may also have caused survey results to be skewed, so it may take time for the full picture to be revealed in fundamental data.

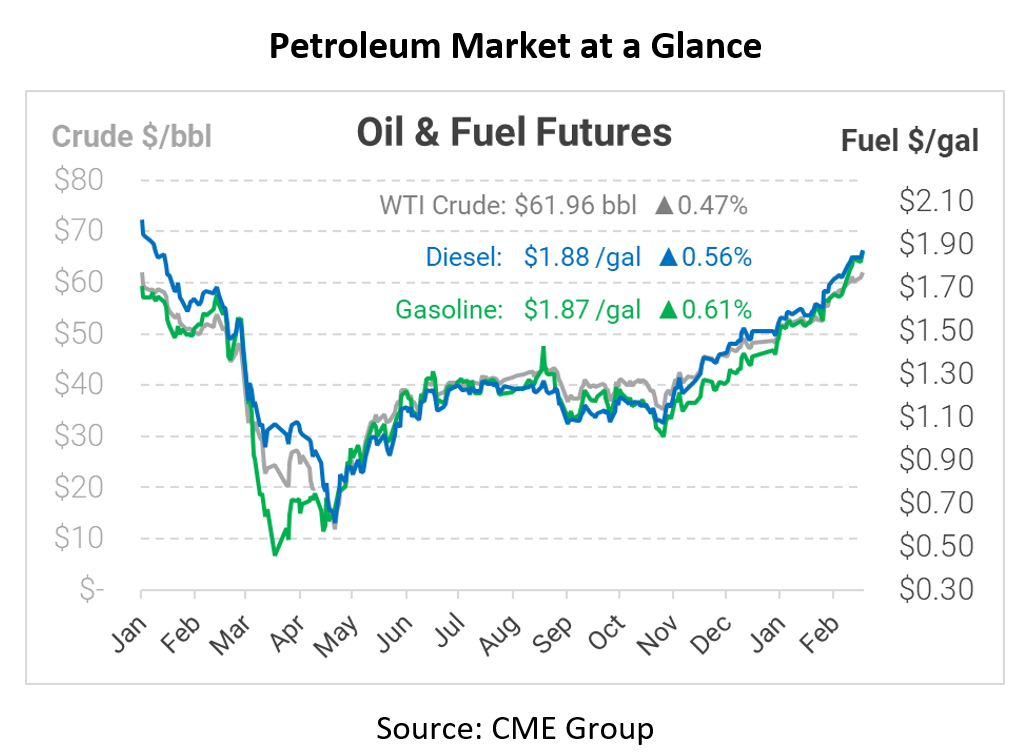

After yesterday’s gyrations, oil is trading a bit higher this morning, though not quite at the multi-year highs seen Tuesday morning. Crude oil is trading at $61.96, up 29 cents this morning.

Fuel prices are also moving higher today. Diesel is trading at $1.8784, up 1 cent from Tuesday’s closing price. Nipping at its heals, gasoline is trading at $1.8700, gaining 1.1 cents.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.