Fed Hikes Interest Rates, ’19 Seen More Dovish

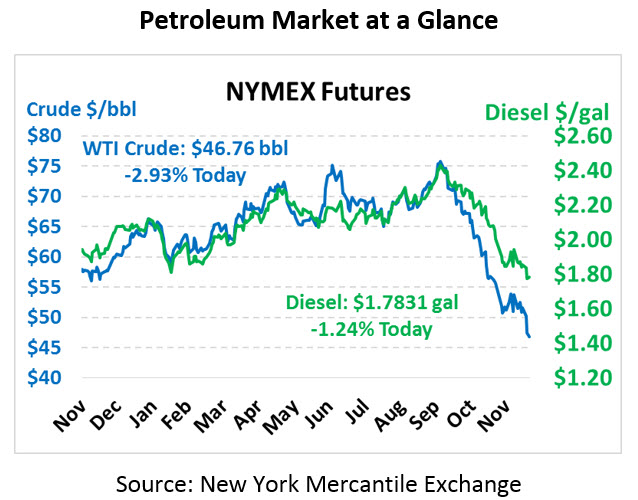

After rallying a dollar yesterday, prices reversed overnight as weakness in the stock market bled over to commodities. Crude prices are trading at $46.76, down $1.41.

Fuel prices are lower this morning, giving back their gains from yesterday when diesel and gasoline prices rose. Diesel prices are trading at $1.7831 this morning, down 2.2 cents. Gasoline prices are at $1.3656, down 2.1 cents from yesterday.

Contributing to the sell-off in the market was an announcement from the Fed that interest rates will increase another 25 points, now trading between 2.25% and 2.5%. As we covered the other day, rising interest rates constrict the money supply, leaving less money to be used for consumption and negatively impacting fuel demand. Rising rates also make American bonds more attractive, causing international investors to buy US Dollars so they can access the bonds. This process strengthens the dollar relative to other currencies, making oil more expensive internationally and negatively impacting oil prices. In their report, the Fed took a more dovish stance, revising the expected number of rate hikes in 2019 from three down to two.

The EIA released their weekly inventory data yesterday, providing yet another bullish indicator that was ignored by the market. Crude stocks, which the API showed building by 3.5 million barrels, actually experienced a small draw. Diesel stocks saw a large draw, while gasoline’s build was in line with expectations. The report showed continued tightness in the market, especially for diesel, which saw demand rise by 417 kbpd week-over-week while production fell.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.