European Lockdowns and Libya Supply Trigger Selloff

Markets are slipping this morning as coronavirus cases continue mounting worldwide. Both the US and European countries are setting new records for number of new cases reported, which adds to concerns that lockdowns will be required heading into the winter. European countries including Spain, Italy, France, the UK, and Ireland have all tightened restrictions over the past two weeks, with Ireland issuing a second full lockdown last week.

Adding to this morning’s bearish case, Libya is now on track to reach a full 1 million barrels per day over the next few weeks, according to their National Oil Company. Such a large increase could only be offset by steeper OPEC+ cuts. The OPEC+ group has repeatedly reiterated their support for balancing markets but has yet to change their 2021 cut strategy. If they do not follow through with action, markets will respond harshly, and prices will likely fall even more sharply than they already have.

In the Gulf, producers are beginning to evacuate workers from offshore rigs as Tropical Storm Zeta approaches. The storm is expected to strengthen to a hurricane before making landfall along the US Gulf Coast. A reduction in Gulf crude output could temporarily counteract rising production in Libya, though don’t expect that effect to last long. Storms typically have a bullish effect on prices as they approach, but high inventories have kept markets calm throughout this year’s record-breaking storm season.

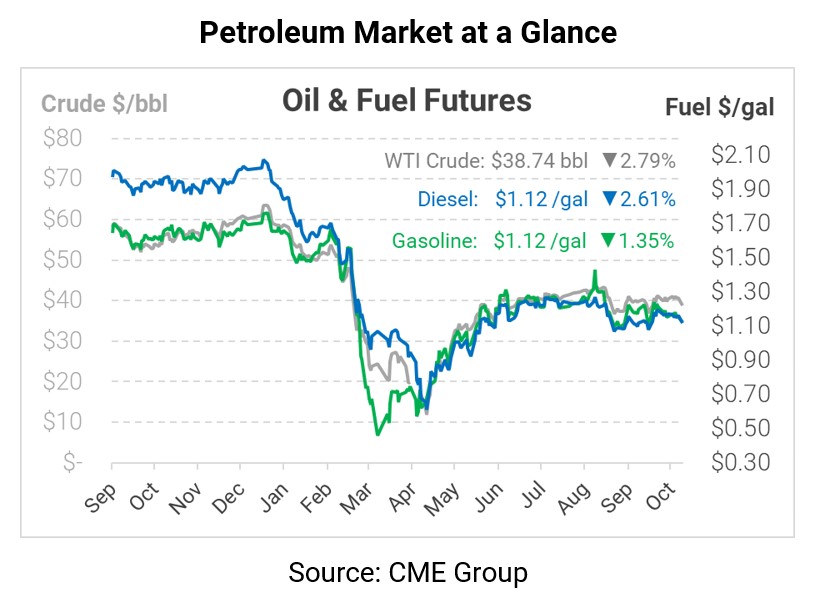

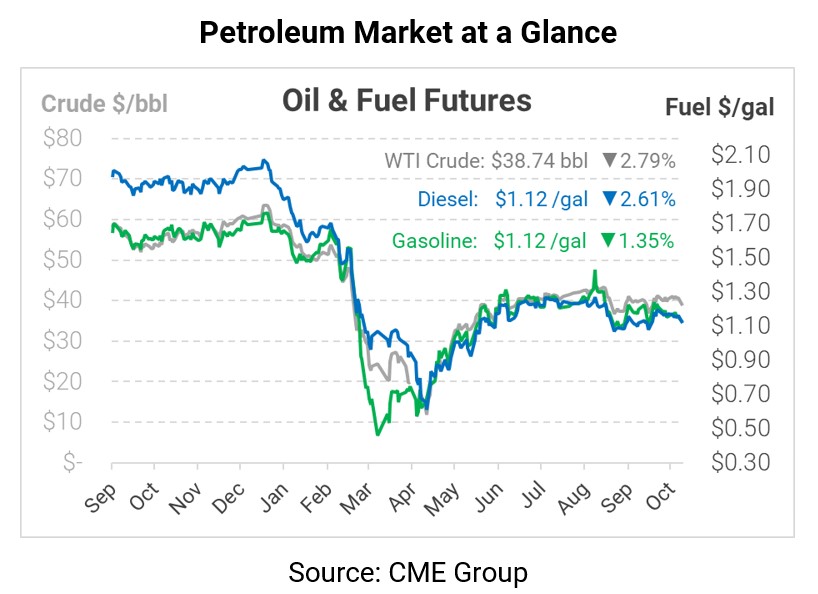

Crude oil is trading significantly lower this morning, overwhelmed by excess supplies and tepid demand. WTI crude is trading at $38.74, a loss of $1.11 (-2.8%) since Friday.

Fuel prices are also sinking, though gasoline remains more buoyant than other products. Gasoline is trading at $1.1235, down 1.5 cents (-1.4%) from Friday’s closing price. Diesel is falling in line with crude, hitting $1.1213 for a loss of 3 cents (-2.6%).

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.