Energy Survey Shows Gloomy Oil Production Outlook

The oil market is trading moderately higher this morning following declining prices last week. A resurgence of coronavirus cases has spooked the market, but thus far demand has not been weakened by states slowing their reopening approach. In fundamentals news, rig counts continue to set new record lows each week, though Friday’s Baker Hughes Rig Count report showed just one oil rig lost in the US. Behind those declining rig counts is an entire industry of exploration and production companies, who are surveyed each quarter by the Dallas Federal Reserve to get a pulse of the Texas economy. Today, we’ll examine what trends the oil exploration and production companies are monitoring over the coming years.

Dallas Fed Energy Survey

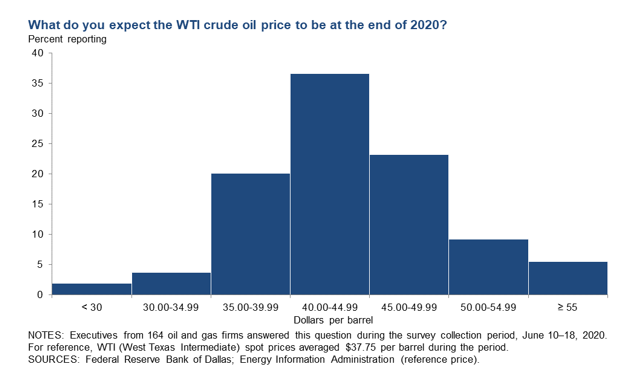

The Dallas Federal Reserve released its quarterly energy survey last week, which revealed several interesting statistics regarding the future of energy markets. Roughly 75% of oil and gas executives expect crude oil to end the year above $40/bbl, with several forecasting $50+/bbl crude. The average forecast across 164 oil and gas firms was $42.11, up $2/bbl from last month’s survey which asked the same question.

Along with higher prices, executives are optimistic about the opportunity to restart production. Thirty percent of executives below that re-starting will begin with crude in the $36-40/bbl range, while 19% believe even lower prices are sufficient. Still, 51% believe that higher crude prices (above $40) will be necessary to bring back horizontal shut-in wells.

While some production may come back in the near future, many producers expect that the US will never return to pre-COVID production levels. Roughly 40% expect depressed production rates to last until 2022 or later, while 41% expect production to surpass pre-COVID levels sometime in the next 18 months.

The survey ends with a sunny disposition – 95% of firms asked indicated they expect to remain solvent throughout the crisis, while just 5% expect solvency issues. This despite a solid majority expecting oil consumption to remain below pre-COVID levels until 2022.

Today’s Price Trends

Crude oil is trading barely higher this morning, supported by lower-than-expected demand declines even as states tap the breaks on reopening. Crude oil is trading at $38.60 this morning, up $0.11 cents.

Fuel prices are seeing comparatively higher gains this morning. Diesel is trading at $1.1498, up 1.4 cents from Friday’s closing price. Gasoline prices are also up 1.4 cents, trading at $1.1677.

This article is part of Daily Market News & Insights

Tagged: Dallas Fed, Oil production, orecast

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.