EIA Updates Data, Forecasts Lower Supply and More Demand

The EIA updated their monthly Short-Term Energy Outlook (STEO) yesterday, providing updated information on the state of domestic and global energy markets. Among some of the top findings:

- The EIA cut its US crude oil output forecast, reflecting weaker drilling in response to lowered prices of crude.

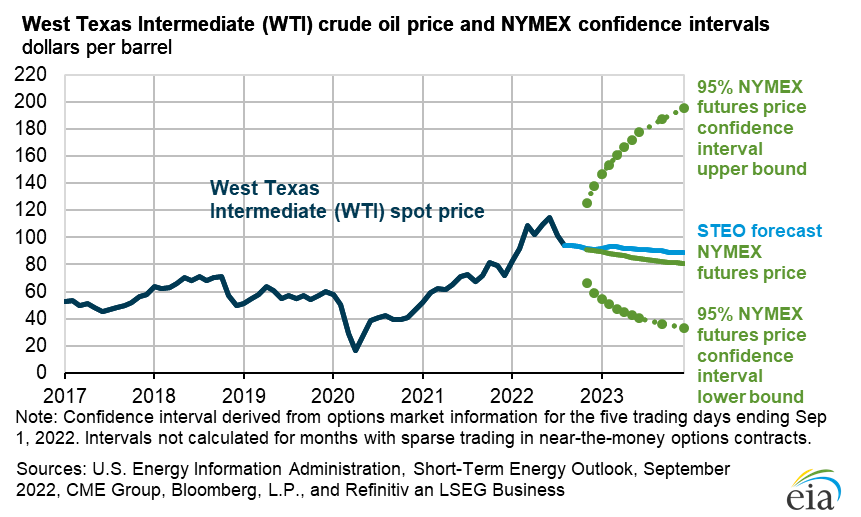

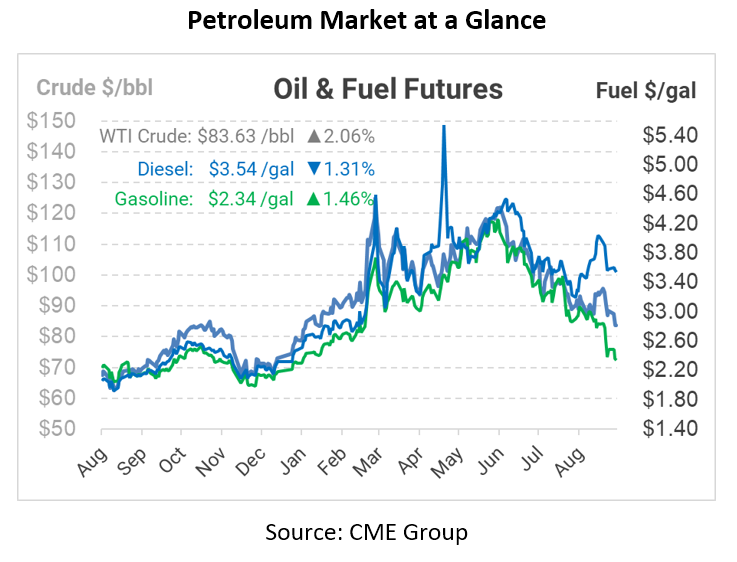

- WTI crude price forecast was raised by over $1/bbl to $90.91 for 2023. The retail diesel forecast was increased by 14 cents to $4.28, while gasoline prices held steady from the August update.

- Global oil demand for 2022 was raised by 100 kbpd to 99.53 million barrels per day, despite a sharp decline in Chinese consumption. Demand next year stayed the same, and global supplies were generally unchanged.

Beyond those key revisions from last quarter, the EIA is projecting global markets to be slightly oversupplied in Q4 2022 and undersupplied in Q1 2023, then reaching a balance for the remainder of next year. Winter demand will be a particular challenge, as curtailed natural gas shipments from Russia to Europe will force power companies to use alternative fuels such as coal and oil to generate electricity. After a tight winter, markets may improve – assuming Russia does not cut off its oil sales to squeeze global markets.

What does all this mean for energy prices? The EIA expects US crude oil prices to average $91/bbl next year, slightly above current prices. Although crude prices will remain high, fuel crack spreads will decline, leading to lower fuel prices overall. The EIA expects retail diesel prices to average 70 cents lower next year compared to 2022 levels, while retail gasoline will cost almost 40 cents less. At the wholesale level, the EIA expects bulk diesel leaving refineries to average $3.63 this year, and fall to $3.05 in 2023.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.