EIA Reports Biggest Petroleum Draws in 18 Months

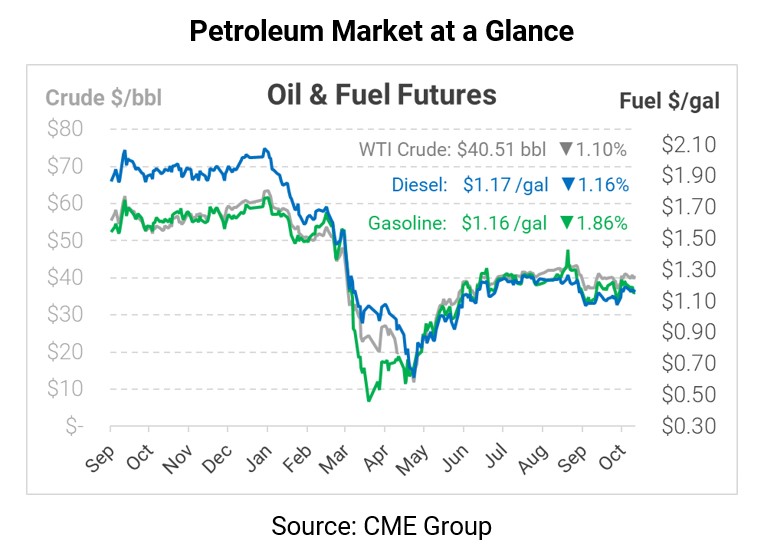

Prices whipsawed yesterday, plunging by a dollar early in the day before rising following the EIA’s bullish inventory report. By the end of the day, prices closed less than 10 cents off from Wednesday’s closing level. This morning, prices are trading slightly lower, with gasoline leading the way.

The EIA’s weekly report showed a crude draw that surpassed expectations, though not quite so much as the API had estimated. The market also had to consider a sizable 2.9 MMbbl build in Cushing, OK, the delivery point for WTI crude oil. Across all petroleum products, US inventories fell by a whopping 16.8 million barrels – the largest draw since February 2019, and the largest move in any direction since April and May brought 20+ MMbbl builds.

The crude draw was supportive, but downstream markets were even more fixated on the 7 million barrel diesel draw, which brought diesel stocks within 20% of the five-year seasonal average. After months of persistently high inventories, diesel inventories are finally falling, though they still have 26 million barrels left to burn through to get back to average.

Gasoline stocks fell in line with expectations, which compared to the rest of the report felt like a disappointment. As a result, gasoline losses are outpacing the rest of the market, dragging down 3:2:1 crack spreads (the margin from converting crude oil into gasoline and diesel) in the process.

Crack spreads are trading around $8.45 this morning. If that level holds, it will represent the lowest crack spread since September 22. Before September, one would have to look back to late May to find crack spreads so low. Low crack spreads spell trouble for refiners, who have slowly been increasing throughputs as demand returns. With prices of fuel falling faster than crude oil costs, refiners may be forced to cut back. Lower refinery utilization would be bullish for fuel prices yet bearish for crude.

After see-sawing yesterday, oil markets are showing some moderate losses this morning on the heels of a rising US dollar. In Libya, production has risen from low levels to roughly 500 kbpd, roughly half of their full capacity. And of course, don’t forget pandemic-related lockdowns in various parts of the world. With such robustly bearish news this morning, it’s no surprice that crude prices are struggling. WTI Crude is currently trading at $40.51, down 45 cents (-1.1%).

Fuel prices are seeing relatively larger losses tody, which is driving those 3:2:1 crack spreads lower. Diesel prices are trading at $1.1580, down 1.4 cents (-1.2%). Gasoline prices are leading the complex lower, with prices down 2.2 cents (-1.9%) to $1.1580.

This article is part of Daily Market News & Insights

Tagged: crude, diesel, eia, Inventories

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.