EIA Posts Steep Crude Draw, While Gas Builds

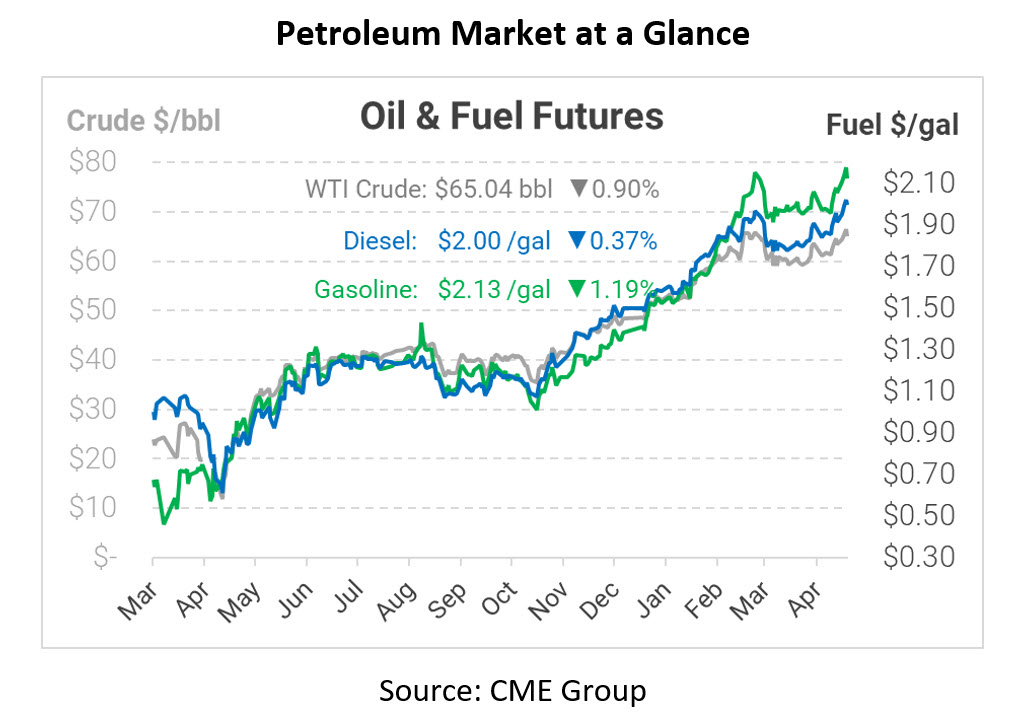

Crude oil prices are turning lower this morning, still just shy of multi-month highs. WTI crude would need to close above $66.09 to beat its March 2021 peak; after that, the next peak would be $66.30, set in April 2019. Despite lower prices, there’s still plenty of positive sentiment stemming from vaccine optimism, which could bring more gains in the future.

The EIA released their weekly oil market data yesterday, and a big focus was the huge 8 million barrel draw in crude inventories. Crude imports contributed to the draw, falling lower in several areas. Diesel also posted a larger-than-expected draw. While crude imports were down, gasoline imports remain strong. America’s strengthening economy has made it an attractive target for gasoline exporters in other countries, facing weak demand in their own markets. Combined with a 14-month high in refinery utilization, robust imports contributed to gasoline’s build.

Renewable energy continues to be a popular topic in the first few months of the Biden administration, and a new IHS report highlights this trend. America is now considered the most attractive market for renewable energy, followed by Germany and China. The report considered onshore wind, offshore wind, and solar power in its approach. The US led the pack in solar power and onshore wind energy, while the UK took the crown for top offshore wind market. Although most new capacity over the past few years has come from the US and China, many countries have seen double-digit growth of their renewable energy portfolio.

This article is part of Daily Market News & Insights

Tagged: Inventories, Renewables

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.