Economic Headwinds Overshadow Oil Tanker Seizure

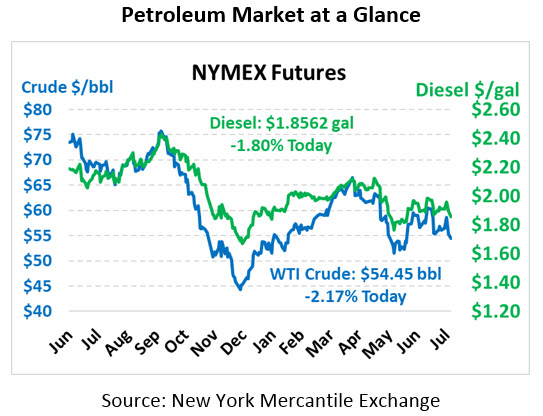

After moderate gains made during Friday’s trading session, the oil complex is once again dipping lower, more in line with the post-tariff crash seen on Thursday. Crude oil is currently trading at $54.45, down $1.21 (-2.2%) from Friday’s close.

Fuel prices are seeing similar losses. Diesel prices are trading at $1.8562, down 3.4 cents (-1.8%) from Friday’s close. Gasoline prices are currently $1.7438, down 3.8 cents (-2.1%).

Markets are still reeling from last week’s combo attack on positive sentiments. Starting on Wednesday, Fed Reserve Chairman Powell characterized the interest rate cut as merely a mid-cycle adjustment rather than a broader bias towards cuts, sucking the wind out of those expecting a more dovish stance this year. Then President Trump on Thursday announced 10% tariffs on $300 BN of Chinese goods. With the US economy now firmly pushing into the longest expansionary period in history, many fear trade may be the factor that pushes us into recession this year or next. Depending on its severity, a recession could significantly decrease oil demand and cause prices to plummet even further.

Yet there are still bullish notes. Reports over the weekend revealed that Iran has captured an Iraqi oil tanker commuting through the Strait of Hormuz, bringing the total number of seized ships to three. While an all-out conflict between Iran and Western countries still seems unlikely, the steady flow of provocative measures makes some type of miscalculation more possible. From seizing ships to shooting down drones to missile strikes, there have been plenty of opportunities for things to spiral out of control in the Middle East. So far, cooler heads have prevailed – but will they continue?

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.