Diesel Spreads Hit Three-Year High

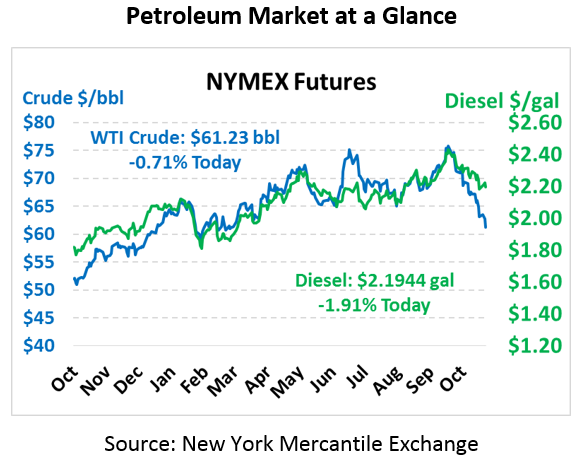

The EIA released their weekly inventory data yesterday, which quickly cut short yesterday’s early morning rally and caused crude prices to give up yet another 50 cents, placing it within just a couple dollars of sub-$60 levels. This morning, crude is trading at $61.23, down another 44 cents (-0.7%) from yesterday’s close.

Fuel prices trading in opposite directions yesterday, with gasoline shedding over 4 cents while diesel prices gained almost 5 cents! The variability shows how differently gasoline and diesel can act during the fall. This morning, diesel has given up nearly all of yesterday’s gains, trading at $2.1944 for a 4.3 cent (-1.9%) loss. Gasoline is $1.6606 this morning, up 1.3 cents (+0.8%) as the market recovers from yesterday’s sell-off.

EIA Reports Record US Crude Production

The EIA released their weekly inventory data yesterday, causing prices to begin cratering right at 10:30 AM after its release. Crude oil production hit a new record 11.6 million barrels per day (MMbpd) – putting the US solidly in first place as the world’s leading oil producer, recently surpassing Russia’s 11.4 MMbpd production. The high crude production caused crude stock builds to outpace market expectations, and also contributed to a 2.4 MMbbl build in Cushing OK, the main US crude storage hub and delivery point for NYMEX WTI crude.

Inventories painted a mixed picture, as gasoline stocks posted a surprise build while diesel prices declined more than markets expected. The varied outlooks caused diesel prices to soar relative to crude (more on that below), but gasoline crack spreads fell from their normal $10-$20 range to just $7.50 yesterday. The spread between gasoline prices and diesel prices are now well over 50-cents. With gasoline inventories abundant and prices cratering, we’ll see whether diesel crack spreads are enough to incentivize refiners to keep pumping out fuel at breakneck speeds.

Diesel Crack Spreads Hit Three-Year High

While crude oil prices tend to trade in tandem with fuel prices, yesterday’s diesel rally is a salient reminder that specific factors can play on each product. Diesel stocks fell despite rising refinery utilization, showing how tight diesel markets currently are. The large diesel gains yesterday pushed diesel crack spreads – the different between a barrel of diesel and one of crude – to $32, the first time spreads have passed that level since winter storms caused supply concerns in Feb 2015.

Yesterday’s diesel crack spread widening comes at an interesting time, as markets look ahead to the end of 2019 when IMO 2020 begins going into effect. Most in the market expect at least a $5-$10 increase in diesel crack spreads in the latter half of 2019, perhaps even more. Divide to get gallons, and that’s a 12-25 cent price increase on the conservative side. Other analysts have pointed to a $10-$20 increase. Those increases would be added on top of any current market premiums.

For diesel consumers, the message is clear: Even if crude prices fall, that does not guarantee cheaper fuel prices. Diesel markets have been quite tight for the past year thanks to historically low stocks and a strong US economy, and there’s no sign the trend is changing. Diesel prices historically rise in the winter as heating oil demand picks up, so don’t expect any relief this winter from high diesel prices. For consumers considering locking in a fixed price for 2019, yesterday’s rally is a reminder that waiting for crude prices to dip may not always yield diesel price savings.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.