Diesel Draw Stokes IMO 2020 Concerns

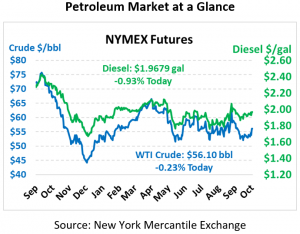

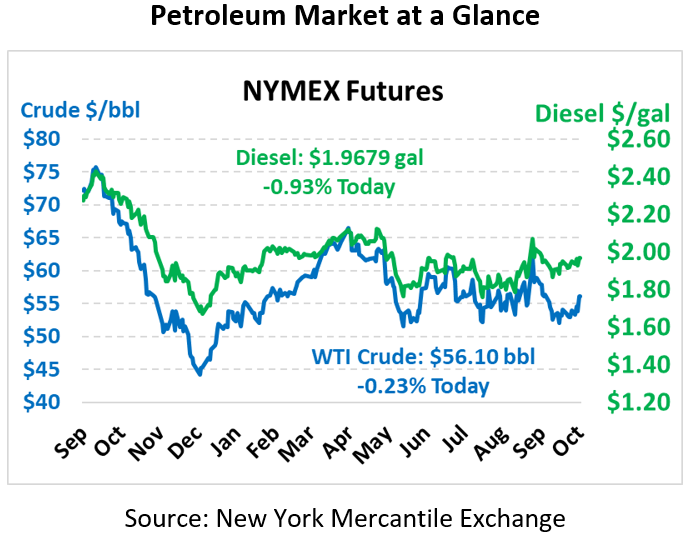

Markets are trending sideways to lower this morning following yesterday’s continued gain for oil markets. Although prices began the day on weak economic data yesterday, the market could not let go of the bullish EIA data. Crude oil is currently trading at $56.10, down 13 cents from yesterday’s close.

Fuel prices are remaining in check as well. Diesel is trading at $1.9679, leading the market lower with 1.8 cent losses. Gasoline prices are trading at $1.6604, down 0.3 cents.

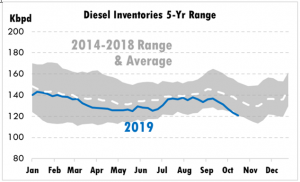

The EIA’s data points to a rapidly tightening diesel market, where inventories have now fallen below the five-year range for this time of year. IMO 2020 is right around the corner, bringing with it increased demand for distillates from the marine sector. With many questions remaining on implementation, markets are concerned that diesel demand could spike even as inventories plummet. Winter weather will also play a part – a cold winter could tax heating oil inventories even further. With just over two months to go until implementation begins, markets will be eying each inventory report for more clues on potential impacts. If demand does rise as expected and inventories remain suppressed, expect significant short-term volatility heading into January.

Correction: In yesterday’s FUELSNews we stated that US crude exports exceeded crude imports. In fact, crude imports remain 2.1 MMbpd above exports. The statement was intended to say that total petroleum product exports (including fuels and other oil products) exceeded total imports. This is still a significant statement, as total exports have only exceeded imports four times since data tracking began in 1991. All four of those occurrences have been within the last year.

This article is part of Crude

Tagged: diesel market, eia, fuel prices, IMO 2020, Inventories, January, winter

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.