Despite Rally, Fuel Demand Remains Weak

Another day, another new multi-month high as WTI crude continues its vaccine rally. The FDA is vetting Moderna’s vaccine and has found it to be highly effective, setting the stage for a second vaccine approval. Additionally, the US government has secured an additional 100 million doses of the Moderna vaccine – enough to treat 50 million people – bringing the total number of Pfizer and Moderna vaccines purchased to 300 million (150 million people treated).

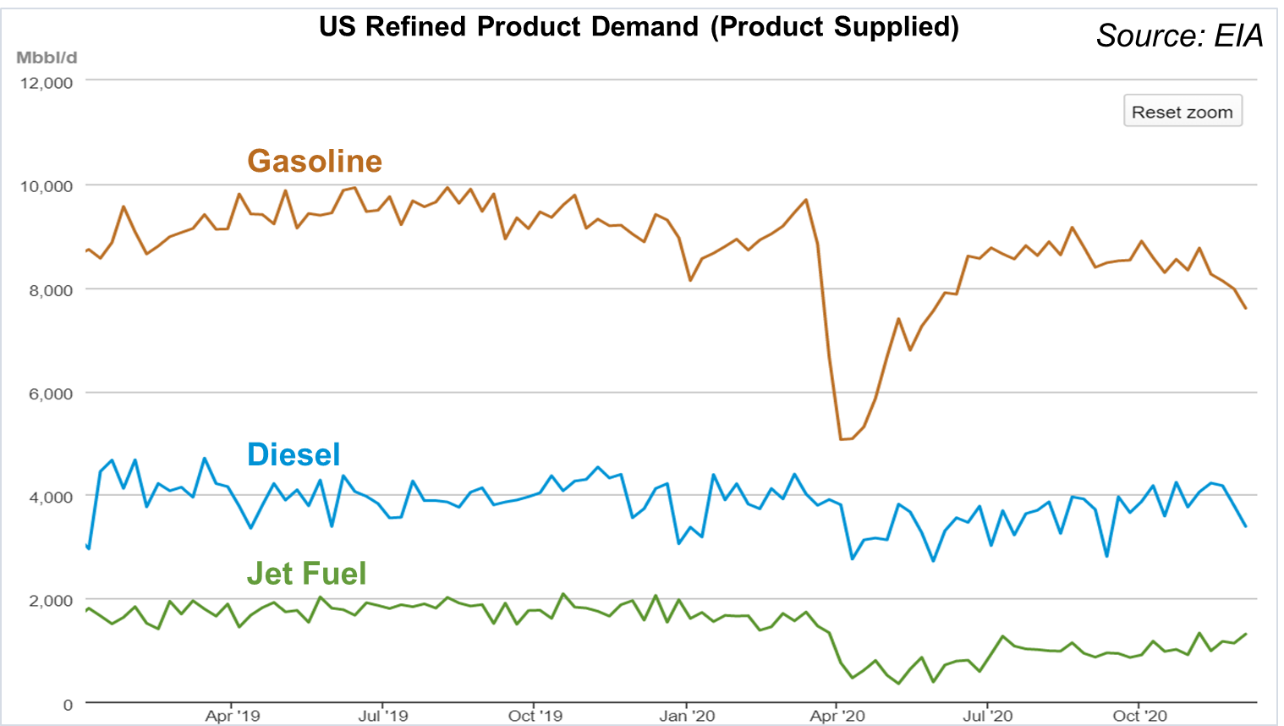

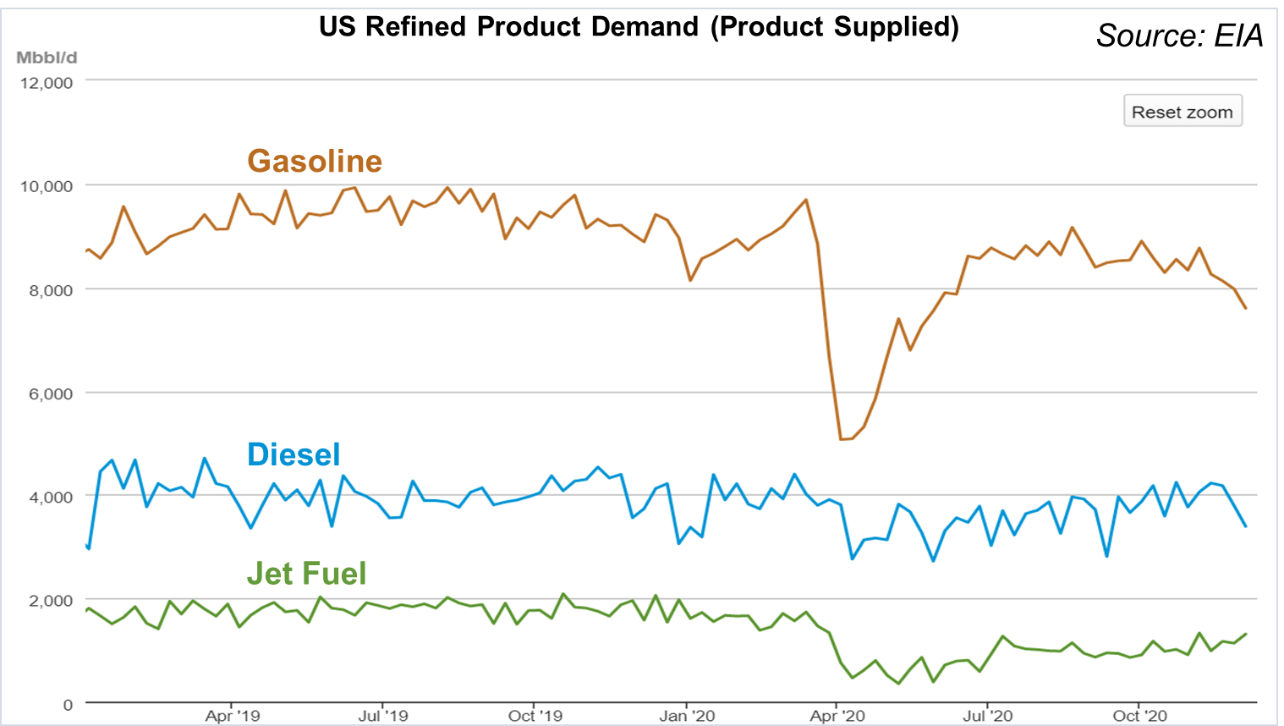

Although prices keep rising, the demand picture in the US does not necessarily support much exuberance. Refined fuel demand remains below pre-COVID levels, and gasoline demand is down to its lowest level since May. Jet fuel continues to climb back to average levels but remains down about 35%. Diesel is close to normal, but one product cannot lift the entire market. Yesterday, we noted that refinery utilization will be a key metric for determining when prices can rise. As a leading indicator, though, demand must return before refineries can increase their output back to normal – and across all refined products, demand remains roughly 10% below the norm.

It’s odd to compare the glowing 2021 expectations with the dismal picture today. With the US surpassing 300,000 fatalities from COVID-19 and lockdowns resurfacing around the world, demand will inevitably take a hit this winter. Yet, with the pandemic raging as hard as it ever has, prices are slowly climbing back to pre-COVID levels. Whether markets maintain their buoyancy or succumb to short-term pressure is yet to be seen; either way, volatility may be ahead. Put another way, if markets are showing enthusiasm now, imagine what they will look like when the pandemic is truly in the rearview mirror.

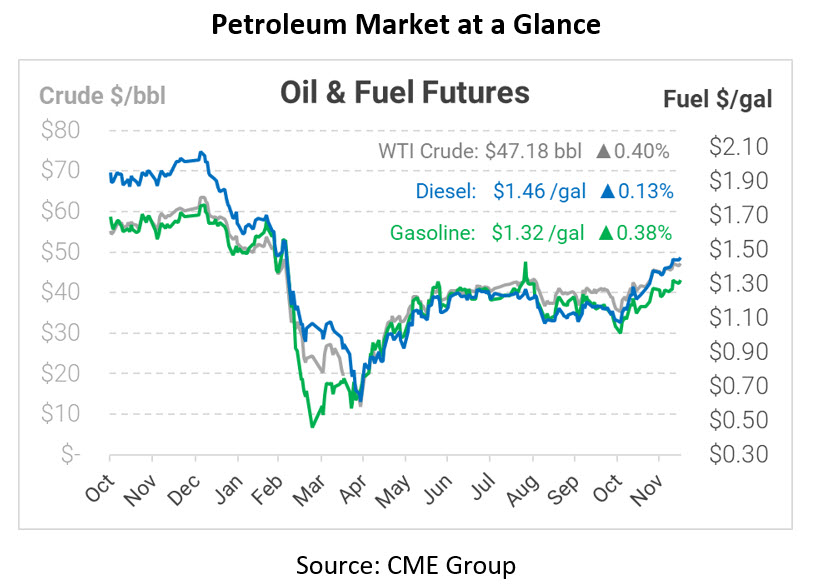

Yesterday saw Brent and WTI crude close at their highest levels since early March, just before the first wave of lockdowns went into effect, and those gains are continuing this morning. WTI crude is trading at $47.18, a gain of 19 cents. Although no particular day this week has brought astronomical gains, the slow and steady progress higher is bring crude oil back to more historically sustainable levels.

Fuel markets are also moderately higher this morning. Diesel is trading at $1.4563, up 0.2 cents from Monday’s closing price. Gasoline prices are $1.3241, up 0.5 cents.

This article is part of Daily Market News & Insights

Tagged: diesel demand, gasoline demand, Jet Fuel Demand, vaccine

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.