Crude Tankers Attacked in the Middle East

The oil complex is showing mixed results this morning. Prices made some upward movement yesterday following constructive inventory data and an attack in the Middle East. This morning, crude prices are taking a bit of a breather, trading down 13 cents at $69.48 currently.

On the other hand, fuel prices are trading in positive territory with gasoline leading the way higher. Both products saw large gains yesterday with diesel closing over 2 cents higher and gasoline increasing over 4 cents. The bump in gasoline prices can be attributed to a larger than expected inventory draw and strong demand. This morning, gasoline prices are $2.1771, a gain of over 1.5 cents. Diesel prices are also trading at $2.1771, a tiny increase of only 2 points.

Tension in the Middle East gave prices a boost yesterday. Saudi Arabia has temporarily halted all shipments of crude in the Bab al-Mandeb Strait due to an attack on two of their tankers in the Red Sea yesterday. The tankers were attacked by a militant group known as the Houthis, who have been involved in a three year war with Saudi Arabia. Roughly 4.8 MMbpd of crude travels through this strait; it is likely crude shipments will be delayed to Europe and the United States due to the possibility for additional attacks.

Iran has already threatened to block the Strait of Hormuz should the US go through with their sanctions in November. Some in the market have postulated that the attack on Saudi’s ships was Iran-backed rebels carrying out a small version of the Strait of Hormuz shutdown.

Week in Review

Oil prices crept slowly higher this week, inching their way back to their post-correction levels. Angry tweets between Iran and Trump this week helped give the market a general uneasiness concerning Middle Eastern tensions. Iran has threatened to shut down the Strait of Hormuz, through which 30% of maritime-bound oil flows, which would immediately cause massive price fluctuations. While Iran is unlikely to follow through on threats, continued agitation from Trump certainly won’t help.

A large inventory draw from crude stocks helped to keep markets elevated, particularly as Cushing inventories fell to their lowest point since November 2014. Although refinery runs fell slightly, overall output of fuels remains strong in the US keeping steady downward pressure on crude inventories. Regional inventories are generally lower than last year, keeping pressure on refineries to keep pumping out more fuel to prevent prices from rising too much higher.

As US-China trade has kept markets concerned about an impending economic crisis, good news emerged from US-EU trade conversations. Both Trump and the European Commission’s President walked away from the meeting on a positive note, with Trump even noting that the US would work towards getting tariffs down to zero in the future. In contrast to the protectionist stance Trump has taken elsewhere, the meeting left a glimmer of hope for international trade prospects. That’s great for businesses, though more trade means higher fuel prices, so it’s a mixed bag.

Brent Slips into Contango

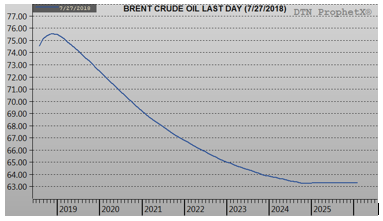

Over the past two weeks, Brent crude oil (the international corollary to America’s WTI crude) has slowly been slipping into contango for 2018 – meaning futures prices are trading higher than current prices. Picture a price graph going up and to the right in the future, as opposed to backwardation which is directed downward. Contango appears prima facie bullish – markets are showing rising prices in the future! In reality, contango typically means the market has plenty of supply right now so they can afford to put some into storage for future dates.

Markets were in contango while prices were in the $40-$55 range, and flipped to backwardation during the entire rise from $55-$75. American crude oil remains backwardated, showing American crude prices may still have room to rise. Brent crude, on the other hand, has slipped to contango for the rest of 2018, though the curve remains backwardated (i.e. bullish) in 2019 and beyond.

Price Review

WTI crude oil began the week at $68.17, pummeled last week by hedge fund trades exiting their positions. This week, prices have slowly been making their way higher, picking up steam on Wednesday thanks to a 6 million barrel crude oil draw. The week opened this morning at $69.58, a gain of $1.41, a 2.1% gain for the week.

Diesel prices also experienced steady growth throughout the week, despite the EIA’s reported diesel stock draw being miniscule. Diesel opened the week at $2.0975, gaining anywhere from 1.5 – 2.0 cents daily since then and opening this morning at $2.1751, a gain of 7.8 cents or 3.7% – far outpacing crude oil’s gains.

Gasoline was by far the biggest winner of the week. Prices opened at $2.0650 and quickly ramped up to today’s opening price of $2.1600, a 9.5 cent and 4.6% gain! Summer demand has taken its toll on gasoline prices, causing inventories to fall 2.3 million barrels even as imports rose week-over-week. Gasoline demand measured at 9.8 million barrels per day in the U.S, 140 kbpd above last week’s numbers. While not quite a record high, it pushes us close to the 10 million barrels per day level markets anticipated could happen this summer, giving gasoline prices a solid boost.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.