Could Recession Fears Be Unfounded?

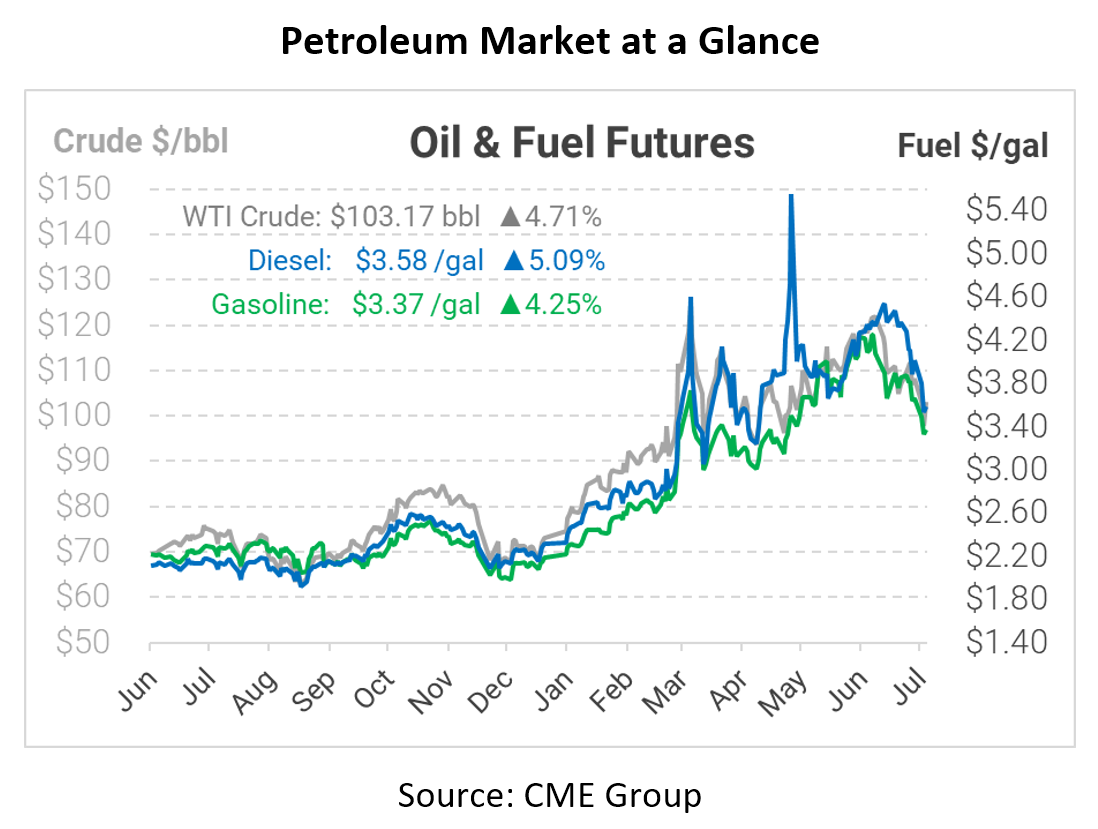

Fuel prices are trading higher this morning, with diesel and gasoline each gaining around 15 cents. Crude oil is now back above $100/bbl, showing a sharp increase this morning. Recession fears are mounting – but at least one analyst thinks that current sentiment might be an “echo” from the 2020 downturn rather than foreshadowing an impending collapse.

Bloomberg reporter and investment manager Barry Ritholtz points to an interesting data point – consumer sentiment tends to collapse a year or two after an economic recession, making sentiment a lagging indicator rather than a leading one. The implication is that, in the years after a big recession (like now), the cacophony of forecasts calling for an impending downturn might be wrong.

Using data from the St Louis Federal Reserve and the University of Michigan Consumer Sentiment Index, he shows that after each recession since the 1990s, there’s a lagging drop in consumer sentiment, despite a strong economy. This was the case in 1992, 2003, and 2011.

If consumer sentiment polls are correct, 2022 is the worst economy in US history – worse than the Dot-Com Crash, the Great Recession, or COVID-19. That feeling is clearly an overreaction to inflation challenges, given a strong labor market and business growth. Ritholtz is quick to point out, though, that the pandemic is a game-changer that may make this time different. No one knows the future. But it’s possible the “sky is falling” mentality circulating the market is merely market psychology, detached from economic reality.

What does this mean for fuel demand and prices? Most importantly, it shows how crucial it is to focus on the fundamentals. Oil demand is still high, and supplies cannot keep up. Moreover, it doesn’t appear that suppliers will be able to catch up, unless demand is diminished via higher prices. So regardless of what commentators say in the media, be sure to keep an eye on the market realities – which show that prices could go much higher before turning lower.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.