Bullish EIA STEO Lift Markets

On Tuesday, WTI Crude finished the day up. It spiked mid-session on the news that OPEC+ may keep supply cuts in place past June. Crude prices are flat this morning, as traders weigh possible OPEC+ plans to deepen supply cuts against demand concerns made worse by a possible second wave of coronavirus infections as countries come out of quarantine. China suffered a setback as it eased restrictions after new cases emerged in Wuhan — the epicenter of the outbreak. This resurgence prompted an order for the entire population of 11 million to be tested for the coronavirus just a few weeks after emerging from quarantine.

A bullish Short-Term Energy Outlook (STEO) report by the EIA helped to lift markets yesterday. The EIA expects crude prices will average $23/b during the second quarter of 2020 before increasing to $32/b during the second half of the year. EIA forecasts that Brent prices will rise to an average of $48/b in 2021. For liquid fuels, firmer demand growth as the global economy begins to recover and slower supply growth will contribute to world-wide oil inventory draws starting in the third quarter of 2020. EIA expects global liquid fuel inventories will fall by 1.9 million b/d in 2021.

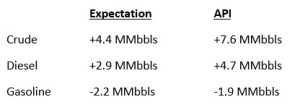

The API’s data last night:

The API reported a larger-than-expected build for crude of 7.6 MMbbls versus an expected growth of 4.4 MMbbls. At Cushing, stocks drew by 2.3 MMbbls – the first draw at Cushing since February. The API reported that gasoline had a smaller-than-expected draw, and distillates had a larger-than-expected increase. The EIA will report numbers later this morning.

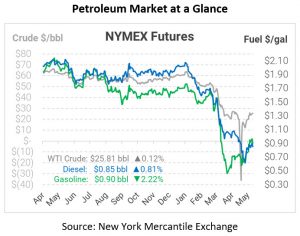

Crude prices are relatively flat this morning. WTI Crude is trading at $25.81, a gain of 3 cents.

Fuel is mixed in early trading this morning. Diesel is trading at $0.8452, a gain of 0.7 cents. Gasoline is trading at $0.8981, a loss of 2.0 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.