Biden Reversing Energy Course to Curb Prices

During a time with consumers seeing some of the highest oil prices in recent memory, the Biden Administration now seeks the help of the industry he spent much time trying to change. The Biden 2021 election campaign focused heavily on curbing climate change by regulating the oil and gas industry. He now faces an even bigger problem as he desperately needs the help of those companies that he once campaigned against.

The price situation has prompted Biden to talk with OPEC+ about increasing global output to curb the increases. This week the administration has also reportedly met with multiple oil giant leaders to discuss the possibility of them lowering oil prices. This most likely will not happen, as Biden’s favor in the minds of these executives has diminished throughout the early stages of his presidency.

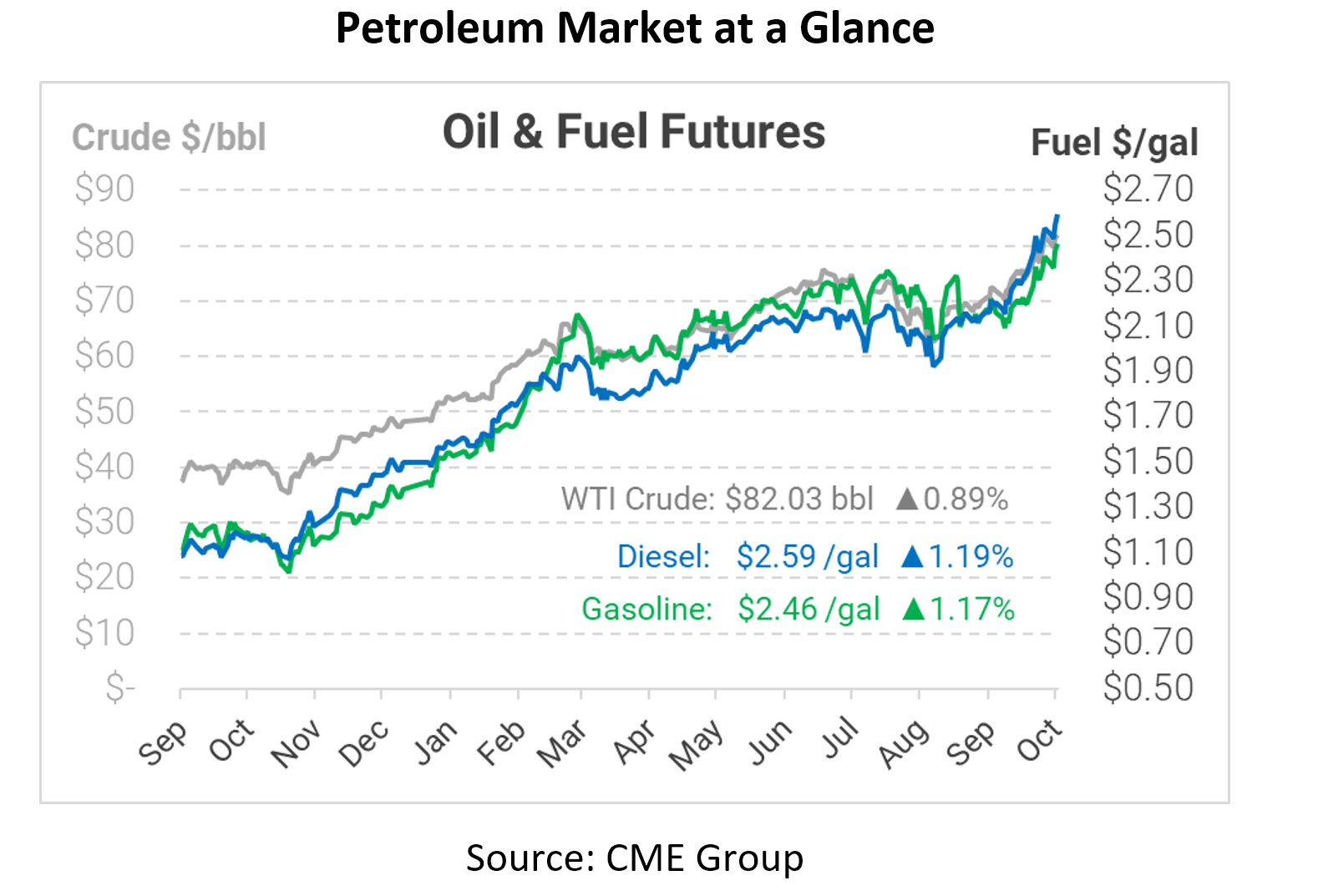

It is no secret that the Biden Administration has sought energy reform since the beginning of their campaign, but they now face a dire situation given rising oil prices in the US and worldwide. Right now, the average price of retail gasoline is around $3.30. Not only are consumers contending with seven-year high gasoline prices, but they also face rising natural gas prices that could raise heating bills by over 30%. With the seemingly never-ending oil price increase and the threatening inflation that the country is experiencing, Biden’s ratings are down, which now threaten his overall agenda and standing with the public. Overall, following forecasts, it is safe to assume that prices will continue to rise steadily over the coming weeks, but the silver lining is that there are many people, organizations, and countries working diligently to prevent this from spiraling out of control.

This article is part of Daily Market News & Insights

Tagged: Biden, oil prices, opec

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.