Beyond the Rumor Mill

Tired of the oil market rumor mill? Heard too much about China and OPEC? We feel you.

Oil prices have been balanced within the $50-$60 range for months now, constantly driven one way or another by speculation regarding US-China trade and OPEC production targets. Nearly every headline on both issues become irrelevant within a week – no real progress has been made, just statements which evaporate in wisps of smoke within days.

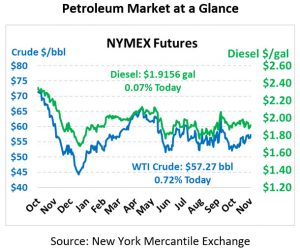

Normally, we share the daily pricing at the beginning of each article. You can find the snapshot of prices in the top right. To summarize, the market is generally trading higher as the broader market picks up steam; the Dow has set several record closes in the past month. But what’s driving broader price trends? Here are three major factors influencing long-term price trends:

US Dollar

Behind the market strength lie numerous factors. Of course, speculation about trade is high on the list. But the US Dollar also has a role to play. Looking at the interplay of crude oil and the US dollar, it’s been a mixed relationship this year. Generally, there’s a strong inverse correlation – when the dollar strengthens, crude prices fall. But fundamental factors led both to move in lock-step at times.

Trade war concerns earlier in the year strengthened the dollar, but crude prices were also coming off a huge correction and were rebounding to match fundamentals. In May and June, both fell at the same time. July brought a more normal inverse relationship, which in October again seemed to fall apart.

What does this mean for oil prices? The factors influencing the market are behaving in an unusual fashion. While normal market forces would push the two indexes in opposite directions, recent economic and geopolitical headwinds are pushing the two towards a closer relationship. Keep in mind there’s still a causal inverse relationship – a rising dollar makes crude more expensive for other countries, depressing demand and causing prices to fall. What we’re seeing is a market so headline-driven that traders are overcoming the USD headwinds.

Supply/Demand

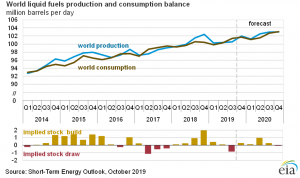

Despite concerns of depressed demand, fundamentals in 2019 have been relatively bullish for prices. Looking at overall global changes in inventories, EIA data suggests that Q1 and Q2 both experienced very small net builds in inventories, while Q3 brought a hefty decline of nearly 1 MMbpd. With inventories largely unchanged throughout the year, it’s not surprising that prices have been calm.

Technology

We’ve all heard about electric vehicles on the roads. While EVs will take a long time to become cost-competitive in the heavy-duty engine market, they are growing in popularity for light-duty and consumer vehicles. The key hold-up for EVs is battery cost. Several reports over the past few years have pointed towards $100/kWh as the key threshold for cost competitiveness with normal combustion engines. Over the last few months, both Tesla and Volkswagen have claimed to be on the cusp of passing this critical inflection point.

Although some predict EVs to radically lower oil consumption and cause prices to come crashing down, most expect oil demand to continue rising over the next few decades. With so many developing economies rapidly growing their middle class, fuel demand isn’t going away. It may shift where it’s being consumed, but it’s not stopping. More impactful than EVs are fuel economy standards, which have slowed somewhat due to relaxed standards set by the Trump administration. Together, while short-term demand has been a popular topic, long-term oil demand prospects show no sign of slowing. For oil prices, don’t expect a huge crash anytime in the next few decades.

This article is part of Crude

Tagged: 2019, China, eia, electric vehicles, Inventories, oil prices, opec, Tesla, trade war, Trump administration, US Dollar, US-China trade, Volkswagen

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.