Are Fuel Prices Overheated?

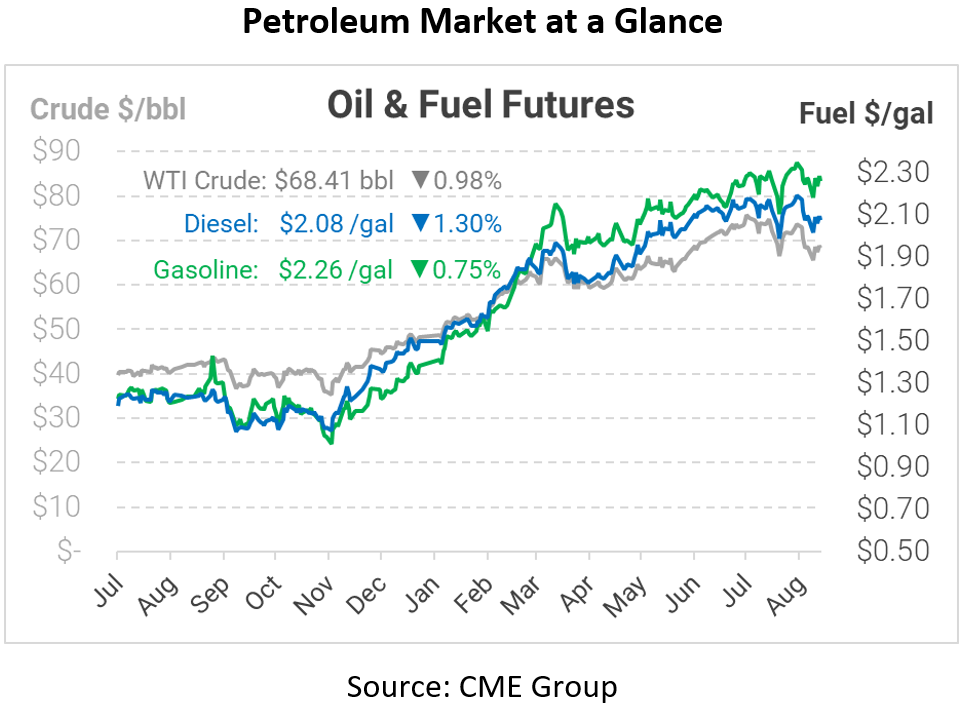

Oil prices are trading sideways/lower this morning, with fuel markets outpacing crude losses. Over the past few weeks, fuel prices have been steadily outpacing crude oil gains, causing refiner margins – represented by 3:2:1 crack spreads – to rise.

The 3:2:1 crack spread represents a refiner’s margin from converting a barrel of crude oil into 2 parts gasoline and 1 part diesel. The calculation isn’t precise – refiners produce a spectrum of products, including gasoline, diesel, jet fuel, kerosene, plastic chemicals, bunker fuel, asphalt, and more. But the most profitable products, and the largest by volume, are typically diesel and gasoline, so those two are used to represent refiner margins.

Typically, 3:2:1 crack spreads vary between $11-$24 per barrel. Below that, refiners are unprofitable and begin to shut off operations. Above that line, refiners tend to crank up their throughput, flooding the market with products and sending prices lower. Currently, the spread is just shy of the $24/bbl mark, suggesting that fuel markets are very tight and refiners are not producing enough fuel to keep up with demand.

Looking ahead, an elevated crack spread usually incentivizes refiners to increase their output, causing inventories to normalize and bringing prices back into a normal range. Every dollar the crack spread changes equates to roughly 2.5 cents per gallon for fuel prices. Crack spreads falling to $18/bbl would mean that fuel prices fell 12 cents, assuming no change in crude oil prices. Put another way, as refiners react to rising fuel demand, we may see fuel prices fall even if WTI crude oil stays the same. On the other hand, given shifting environmental and post-COVID trends, it’s interesting to see whether crack spreads will enter an elevated “new normal” that keeps prices higher for the foreseeable future.

This article is part of Daily Market News & Insights

Tagged: Crack Spreads, fuel-demand, refinery

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.