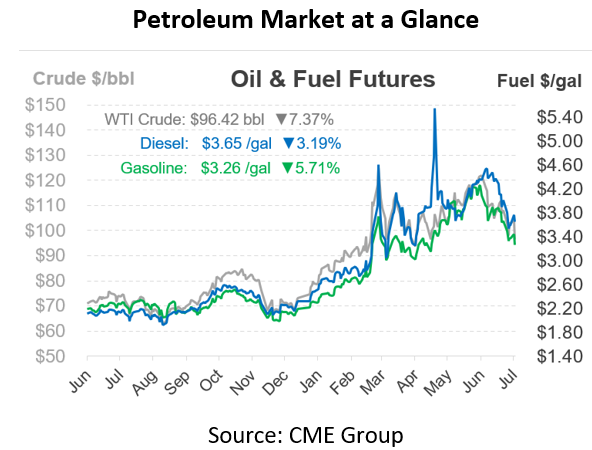

Another Oil Market Selloff Causes 15-Cent Down Day

Fuel markets are once again trading sharply lower today, echoing the sell-off seen last Tuesday after the holiday weekend. Following $7/bbl losses, WTI crude is trading well below $100, and fuel prices are seeing 15-18 cent drops as well. Last week, analysts pointed to light trading due to the holiday week along with technical factors amplifying trader fears about the economy. What’s happening this week?

Economic fears continue to weigh heavily on the market. A recent poll found that the Small Business Optimism Index has fallen to its lowest level since 2013 due to inflation, even while hiring remains strong. The poll also reported that the number of business owners expecting positive economic times over the next six months fell to a 48-year low. Poor future forecasts lead businesses to cut investments, making slow growth a self-fulfilling prophecy. Industries facing the toughest inflation challenges, such as agriculture and retail, show significantly lower sentiment compared to the average. Transportation companies are closer to the average – still low, but not as low as some other industries.

Conversely, OPEC’s Monthly Oil Market Report was released this week, showing slightly reduced fuel demand in 2023 but still solid economic growth. World GDP will grow at 3.2%, though their report acknowledges that it assumes major economies “revert back towards their growth potentials” and are not hindered by the Russia-Ukraine conflict or inflation. Gasoline and diesel are expected to take the lead for oil demand growth thanks to increased mobility in the US, China, and India.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.