3 Reasons Oil Prices Should Fall (And the 1 Reason They’re Not)

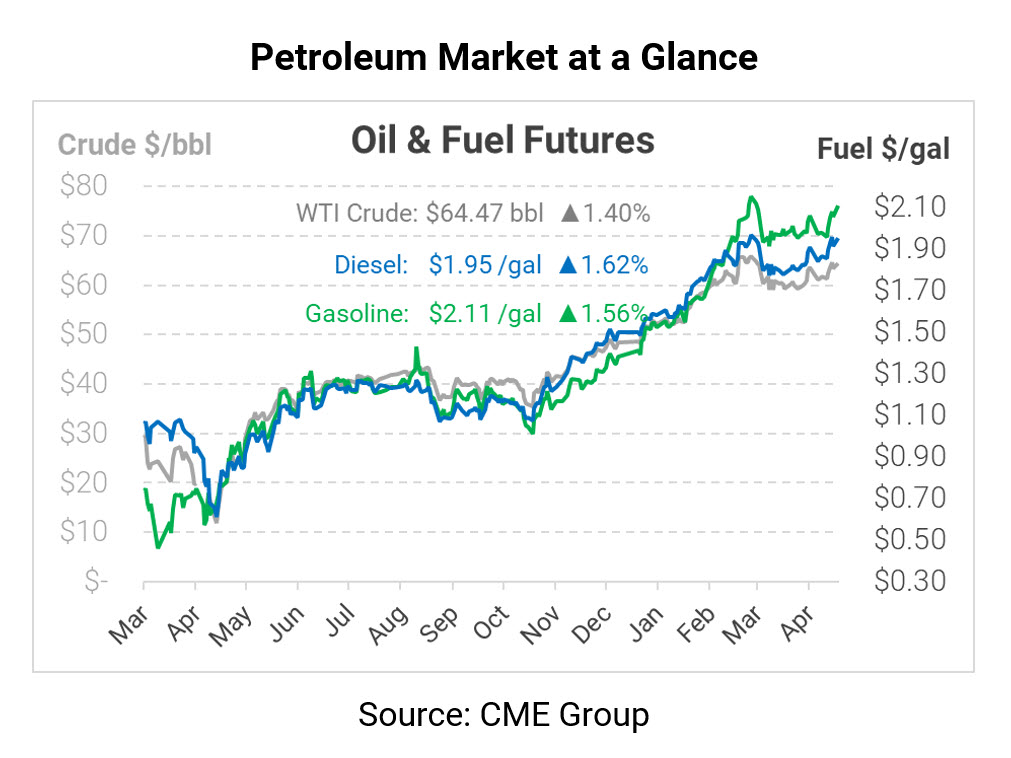

Oil prices are rising again this morning, retracing some of last week’s gains that were lost on Thursday and Friday. Although prices have been higher the past few trading sessions, there’s plenty of bearish news to cloud trader sentiment:

- OPEC’s supply cuts went into effect on May 1, adding nearly half a million barrels per day to global markets.

- India’s fuel demand is down 6% month-over-month, and further losses are expected as COVID cases rise.

- The US and Iran seem to be making solid progress in negotiations, with Russian envoys pointing to “indisputable progress.” A full deal could ultimately return 2 MMbpd of Iranian exports to the market.

With those three heavyweights hanging on the market, it’s surprising that prices have seen such growth over the past few days. But as we noted on Friday, those factors are being outweighed by enthusiasm as we approach H2 2021. Most forecasts point to a large uptick in global demand in the second half of the year, once most vaccine programs take hold and normal consumption can resume. Goldman is calling for 5.2 MMbpd of pent-up demand to resume by the end of 2021, requiring a big response from OPEC to keep up.

Demand in the US and China is already a bright spot. US Gasoline demand trends are getting close to pre-COVID levels, and both countries have administered around 250 million vaccine doses each. It bodes well for future demand that the two largest economies (and fuel consumers) in the world are moving in the right direction. As other countries solidify their vaccine programs, more progress will be made, lifting global demand.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.