Week in Review: Trade Tensions Push Prices Lower for Second Week

Fuel prices are set for their second consecutive weekly decline, with concerns over a potential recession sparked by the escalating trade war between the U.S. and China. Today, Brent crude futures are down almost 20 cents at $63 per barrel, while U.S. West Texas Intermediate crude fell over 20 cents to $59. Both Brent and WTI are on track for weekly declines of 3.8% and 3.5%, respectively, after a drop of about 11% last week. At one point, Brent dipped below $60 a barrel, its lowest since February 2021.

Trade tensions worsened this week as China announced it would increase tariffs on U.S. goods to 125%, up from 84%, after President Trump raised tariffs on China to 145%. This escalating tariff conflict is weighing on market sentiment, reducing global trade volumes and oil demand, which in turn is placing downward pressure on oil prices.

Despite President Trump’s announcement of a 90-day delay on some tariffs, the weight of the trade war is already pressuring prices due to the ongoing trade negotiations and heightened tensions. The U.S. Energy Information Administration lowered global oil demand growth forecasts, citing the impact of tariffs. As global economic growth slows, analysts predict oil consumption could decline by 1%. Additionally, fresh U.S. sanctions on Iran have largely been overlooked by traders, who are more focused on the trade dispute with China.

On the demand side, China’s crude imports reached a notable 10.6 Mbpd in March, the highest level since October 2023. This included record levels of Iranian crude, rising to 1.8 Mbpd, suggesting that despite sanctions and ongoing geopolitical tensions, China’s oil demand remains resilient. China’s imports from Saudi Arabia are expected to rise significantly in May to 48 million barrels, up from 35.5 million in April, which may signal tightening supply from other sources.

On the production side, the Keystone pipeline operator is working on repairs after a 3,500-barrel oil spill or 147,000 gallons in North Dakota, though this will likely have minimal long-term impact on supply.

Prices in Review

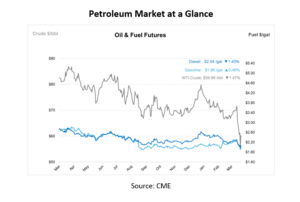

Crude prices opened at $61.12 on Monday and saw volatility throughout the week resulting from the ongoing tariff war. Prices dipped on Tuesday, opening slightly lower at $61.03. The downward trend continued on Wednesday, with prices falling to the weekly low of $58.32. A brief rebound on Thursday saw prices climb to $62.71, but they ended the week at $60.20 on Friday. Overall, crude prices experienced a decline of $0.92, or 1.5%, for the week.

Diesel prices opened at $2.0701 on Monday and fluctuated throughout the week. Prices increased slightly on Tuesday, reaching $2.0784 before dropping to the weekly low of $2.0232 on Wednesday. A rebound occurred on Thursday, with prices climbing to $2.1226, but by Friday, diesel prices settled at $2.0545. Overall, diesel prices decreased by $0.0156, or 0.76%, for the week.

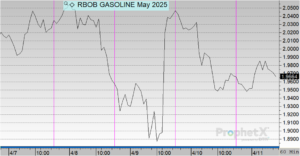

Gasoline prices opened at $2.0400 on Monday and saw fluctuations throughout the week. Prices dropped on Tuesday to $2.0157, continuing their decline on Wednesday, reaching the weekly low of $1.9585. However, prices increased on Thursday, rising to $2.0375, before settling at $1.9671 on Friday. Overall, gasoline prices decreased by $0.0729, or 3.57%, for the week.

This article is part of Daily Market News & Insights

Tagged: Week in Review

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.