Oil Prices React to Trade Tensions, Sanctions, and Production Trends

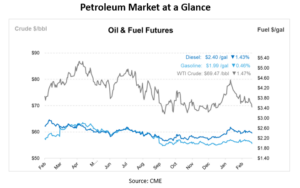

Oil prices are under pressure as geopolitical developments, trade policies, and supply constraints continue to impact market dynamics. This morning, crude futures declined by nearly 40 cents per barrel, reversing the previous session’s 30-cent gain. Brent crude was trading at $74.21 per barrel, while WTI stood at $70.16 per barrel. The decline follows US President Donald Trump’s confirmation that tariffs on Canadian and Mexican imports will proceed as scheduled, raising concerns about potential trade disruptions. At the same time, the US imposed new sanctions on individuals and vessels linked to Iranian oil exports, tightening global supply. Meanwhile, discussions between President Trump and Russian President Vladimir Putin about ending the Russia-Ukraine conflict have introduced speculation about potential shifts in energy sanctions, with Ukrainian President Volodymyr Zelenskiy expected to visit Washington this week to negotiate a natural resources agreement.

The possibility of lifting Russian sanctions could increase global oil availability, but ongoing US restrictions on Iranian exports may offset some of that effect. Additionally, the European Union and the United Kingdom have expanded their list of sanctioned vessels involved in transporting Russian oil, restricting storage in European facilities and limiting the reach of Russia’s shadow fleet. While these factors put upward pressure on prices, weaker consumer sentiment data from the U.S. and concerns about a new coronavirus strain have raised questions about demand growth, adding a bearish element to the market outlook.

On the supply side, Iraq is preparing to resume crude exports of up to 185,000 barrels per day from Kurdistan after a nearly two-year halt due to a payment dispute. South Sudan has also shipped its first crude cargo since its export pipeline was damaged in February 2024 during the ongoing civil war, with previous exports averaging around 100,000 barrels per day.

The US crude oil production is projected to continue rising, with the Energy Information Administration forecasting an average of 13.59 million barrels per day in 2025 and 13.73 million barrels per day in 2026. Higher domestic output may help stabilize supply levels, but production constraints in other regions are adding uncertainty. In South America, Brazilian regulators have intensified scrutiny on offshore drilling, delaying exploration and production projects. At least three drill ships have been halted in recent months, slowing exploration of untapped oilfields and delaying auxiliary wells in older discoveries, making it harder for Brazil to recover from last year’s crude production decline. In Asia, China’s independent oil refineries are facing growing financial pressure due to stricter tax policies, rising costs, and declining oil product demand. Local authorities are reducing tax rebates on fuel oil, one of the refiners’ cheaper feedstocks, from 100% to about 60%, forcing refineries in provinces like Shandong to cut processing rates.

Energy demand trends remain a key focus for the market, with analysts anticipating more clarity after China’s upcoming economic policy announcements in March. The country’s economic direction will be crucial in determining whether demand-side factors can support higher prices. While uncertainty remains, strong refining margins are providing some support to the market, particularly in the US Gulf Coast and Northwest Europe, where demand for distillates and fuel oil has remained robust. The global crude production is expected to average 77.44 million barrels per day in 2025 and 78.39 million barrels per day in 2026. However, new factors, including Trump’s pledge to revive the Keystone XL Pipeline, could further shift North America’s energy landscape. The pipeline, initially canceled by the Biden administration in 2021, was expected to carry 830,000 barrels per day of Canadian crude to Nebraska. Trump has urged the former developers of the project to return, promising an expedited approval process, though regulatory and financial hurdles remain.

Oil prices remain sensitive to both supply-side constraints and shifting geopolitical conditions. The impact of new trade policies, sanctions, and production trends, with many analysts expecting the $70 to $82 per barrel price range for Brent, established between December and January, is projected to persist in the near term.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.