Shifts in Oil Dynamics with Canada’s Trans Mountain Expansion

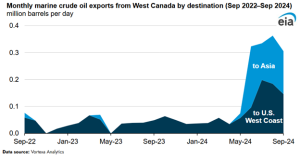

The Trans Mountain Expansion Project (TMX) became operational in May 2024, marking a significant milestone in Canadian energy infrastructure. This project, which nearly tripled the capacity of the original Trans Mountain Pipeline (TMP) from Alberta to the British Columbia coast, now enables up to 890,000 barrels per day (Mb/d) of crude oil to flow to export markets.

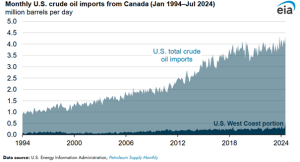

According to the EIA report, the US crude oil imports from Canada hit a record 4.3 million barrels per day (b/d) in In July 2024. Historically, most crude oil from Alberta was transported to US Midwest refineries via pipeline or shipped by rail to the US Gulf Coast for domestic refining or re-export by sea. With the addition of TMX alongside the existing Trans Mountain pipeline, higher crude oil volumes are now transported to British Columbia’s coast, allowing direct exports to buyers across the Pacific.

Impact on Gulf Coast Re-Exports

Between June and September, the US West Coast accounted for just over half of all maritime crude oil exports out of Western Canada, with the rest going to destinations in Asia, according to data from Vortexa Analytics. The US West Coast imported 498,000 b/d of crude oil in July 2024, according to EIA’s Petroleum Supply Monthly Report, a record high for the region and an increase of 115% compared with July 2023.

Challenges: High Toll Costs and Regulatory Uncertainty

Despite the benefits, TMX faces financial and operational challenges. The project’s final cost of approximately C$34 billion ($24 billion USD) — more than four times the original estimate — translates into high toll fees for shippers. These costs could deter some producers from fully utilizing the pipeline’s capacity.

Additionally, the Canadian Energy Regulator (CER) is set to hold a toll hearing in May 2025, which may result in changes to shipping agreements and cost structures. The outcome of this hearing will play a crucial role in determining TMX’s long-term competitiveness.

Overall, TMX has created much-needed capacity to handle growing Canadian crude production, reducing the risk of export bottlenecks. For the US, the expansion enhances energy security by ensuring a stable and nearby supply of both light and heavy crude. On the Canadian side, access to global markets through the Pacific Ocean provides diversification beyond the US-dominated export routes.

While challenges such as toll structures and shifting trade flows remain, the TMX expansion has undeniably strengthened the energy relationship between Canada and the US, offering long-term benefits for both markets.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.