Why Fixed Price is a Smart Move for Your Business

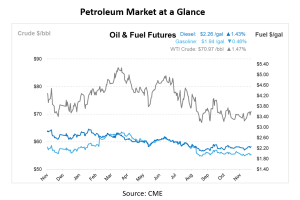

Fuel cost is a topic that always seems to be shifting. One moment, prices are up, and the next, they’re down. It’s hard to predict, right? With so many factors at play, businesses often need clarification about their fuel expenses in the coming months. For fleet owners and operators, this unpredictability can throw off financial plans.

Mac Cullens, Director of the Pricing Department at Mansfield, points out that “retail diesel prices are down almost a dollar from what they were this time last year.” At first, this might sound like a win. However, Mac warns that “low prices might actually be the cure for low prices,” which means we could see prices go up as the economy rebounds. This unpredictability makes it difficult for businesses to effectively plan their fuel budgets.

Protecting Your Budget

As we discussed in our previous article, “Could Fuel Price Changes Wreck Your Budget? Fixed Price is Key to Budget Certainty,” one way to shield against this kind of volatility is by locking in fixed prices when the market is favorable. Mac suggests this approach, explaining that “low prices today might eventually lead to higher prices next year,” that’s why it’s important to consider a fixed-price contract, especially if the business can’t or doesn’t want to pass the extra fuel costs over to customers. This strategy isn’t just about protecting against price hikes; it can also bring financial stability.

With a fixed price contract in place, companies get a predictable rate. That means you can better plan your cash flow and avoid surprises that could mess with your budget. “When you have fixed fuel prices, you’re able to more accurately forecast expenses and allocate your resources without the stress of fluctuating costs,” says Mac.

Long-Term Planning and Growth

Fixed pricing isn’t just about managing short-term risks; it also supports long-term growth. “When your fuel costs are predictable, you have the ability to focus on your business, like expanding your fleet, investing in new technology, or other operational improvements, without worrying about the impact of fuel cost changes in your bottom line,” says Mac.

Moreover, during economic uncertainty or unexpected disruptions, fixed pricing helps businesses navigate challenging times. Mac recalls how, during the COVID-19 pandemic, Mansfield was able to work with clients who had fixed-price contracts. “We worked with customers to ensure they could still meet their obligations, even when demand dropped,” he says. “We didn’t have a single contract default in 2020, thanks to the flexibility and stability that fixed price agreements provided.”

Competitive Advantage

In industries where long-term contracts are common, offering stable prices can give you a significant competitive edge. Take government contracts or project bids, for example—these often require fixed pricing, which means you need to have a clear understanding of your operational costs, including fuel. When fuel prices are constantly changing, it becomes difficult to promise a steady price to your clients. By locking in fixed fuel prices, you can confidently bid on projects, attract clients with reliable pricing, and strengthen your position in the market.

Strategy for Success

As you can see, locking in fixed fuel prices is more than just about managing costs—it’s a smart strategy for navigating the fuel market. With the volatility of the fuel market, taking a proactive approach to securing a fixed price can make all the difference. Whether fuel prices are currently low or high, fixed pricing ensures that your business is prepared for whatever lies ahead. As Mac emphasizes, “The ability to plan and budget with certainty is invaluable, and that’s what fixed pricing provides.” Doesn’t that sound like a solid and smart strategy for your business?

Plan for the Unexpected

With Mansfield Fuel Price Risk Management services, you can plan for the unexpected and mitigate the impact of fuel price fluctuations on your bottom line.

Our Price Risk Management experts will analyze your buying history and organizational goals to give you an analysis of your current fuel spending with a forecasted outlook and recommendations. Contact us today!

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.