Breaking Down the Brent-Dollar Link: Is Now the Time to Lock in Fuel Rates?

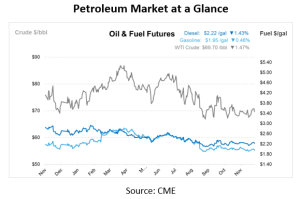

News out of China is driving energy market headlines and sending prices lower. PetroChina’s developments, particularly around its trading strategies, could influence oil flows and market stability. Fresh data on China’s refining demand indicates weaker-than-expected activity, contributing to downward pressure on oil prices. Economic reports reveal slower consumer spending in China, signaling potential long-term demand weakness. This combination of factors could provide short-term price relief but highlights the broader economic uncertainty that may create volatility. Markets are also awaiting the Fed’s widely anticipated 25 basis point rate cut, which has already been priced into the market. Any surprises from the meeting could introduce volatility, as lower interest rates typically boost economic growth and oil demand.

Looking ahead, global oil markets face headwinds from growing non-OPEC+ supplies, particularly from the United States and Brazil. The IEA’s latest report projects a supply overhang of 950,000 bpd in 2024 despite ongoing OPEC+ production cuts. Meanwhile, new EU sanctions targeting Russian shipping and shadow fleet operations are unlikely to disrupt flows significantly, as many now bypass Western regulatory systems.

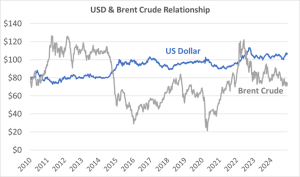

Historically, the U.S. dollar and Brent crude oil prices shared an inverse relationship—a weaker dollar makes oil more affordable globally, increasing demand and prices.

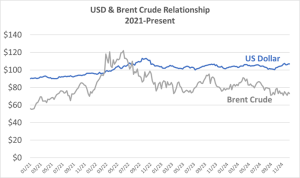

However, since 2021, this relationship has decoupled, and Brent prices no longer consistently move inversely to the dollar index. Statistical data from 2004 to 2021 highlights the challenge: when the dollar index is weak (around 70), Brent prices historically ranged from $50 to $150. Conversely, when the dollar index is strong (around 115), Brent theoretically extrapolates to about $10—a level unseen since 1986. The wide 95% confidence intervals (spanning over $100) make this correlation unreliable as a predictive tool. Additionally, U.S. inflation and relative currency strength against other global currencies further complicate this relationship. Experts suggest adjusting the dollar to “real terms” (e.g., anchored to 2004 values) for a more accurate understanding of its impact on oil prices.

Two questions come to mind when considering this shifting relationship. First, the rise of U.S. crude oil and refined product exports is fundamentally altering global energy markets. As a net exporter, the U.S. can help stabilize prices despite regional demand weakness, such as in China. This export dynamic reduces traditional reliance on Brent-dollar patterns. Second, recent government financial interventions, including monetary stimulus and the release of strategic petroleum reserves (SPR), have distorted energy price signals. These factors introduce uncertainty and limit the predictive reliability of historical Brent-dollar relationships.

For fuel customers, the weaker demand signals from China offer a potential window of opportunity to lock in favorable fuel rates. However, businesses must remain vigilant about long-term dynamics. U.S. export trends are reshaping global markets, while economic policies and government interventions add layers of complexity. Monitoring these factors—alongside inflation-adjusted dollar strength—will be essential for anticipating price shifts and managing procurement strategies effectively.

This article is part of Daily Market News & Insights

Tagged: Brent Crude, crude prices, fuel prices, U.S., USD

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.