Crude Prices Slide on China’s Demand Peak Predictions & Potential US Legislation Reshaping 2025 Outlooks

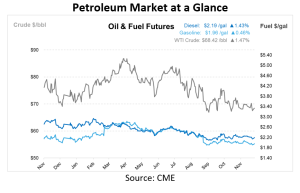

Crude prices have softened, trading down over 5 c/bbl this morning after a sharper overnight drop. This follows China National Petroleum Corp’s projection that domestic oil demand will peak in 2025, driven by a shift away from gasoline and diesel, and fall significantly by 2060. Recent signals from Chinese policymakers of potential fiscal and monetary support have pressured crude prices, pushing them up by approximately $1/bbl yesterday. The market is now awaiting insights from the IEA and OPEC’s upcoming monthly reports, which will offer additional clarity on demand and supply trends.

Oil prices could rise if the Federal Reserve implements expected 25-basis-point rate cuts during its December 17-18 meeting, potentially boosting oil demand in the U.S. economy. Markets remain cautious, awaiting this week’s inflation data, which could impact the Fed’s decision.

California’s Legislative and Refining Challenges

California’s new fuel inventory legislation and refinery closures are reshaping the state’s market. Governor Newsom’s ABx2-1 law mandates minimum petroleum product storage levels to reduce price volatility. The Wilmington facility accounts for less than 1% of U.S. refining capacity, but its closure will tighten California’s already constrained fuel supply, increasing reliance on imports and other state refineries.

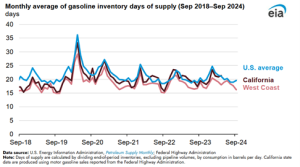

The state’s unique challenges include persistently high retail gasoline prices, averaging $1/gal above the national level, and limited inventories averaging 20 days of supply, below the U.S. average of 21.6 days. Regulatory costs under the Low Carbon Fuel Standard (LCFS) and Cap-and-Trade program, coupled with high acquisition costs for crude, exacerbate supply constraints.

Potential U.S. Tariffs on Canadian and Mexican Crude

President-elect Trump’s proposal to impose a 25% tariff on crude oil imports from Canada and Mexico raises concerns for U.S. refiners, particularly in the Midwest (PADD 2) and Rockies (PADD 4), which rely heavily on Canadian crude. Midwest refineries process over 4.2 Mbpd, with two-thirds of their crude sourced from Canada. The region’s infrastructure, including the reversed Capline pipeline, offers few alternatives for replacing Canadian imports. A tariff could increase input costs, reduce refining margins, and drive up fuel prices, potentially leading to refinery cutbacks or closures.

Canadian heavy oil plays a crucial role in U.S. refining, and its absence would pose logistical and quality challenges, as domestic crude is primarily light oil. PADD 4 refineries face similar hurdles, and a tariff could force refiners to seek less desirable imports, such as from Saudi Arabia or Iraq.

Conversely, the U.S. is less dependent on Mexican crude, which Gulf Coast refineries could replace with other sources. However, logistical and contractual constraints persist. A tariff on Canadian crude seems unlikely due to its economic and political repercussions, and any tariff on Mexican crude would likely be short-lived, given Mexico’s reliance on U.S. refined products.

This article is part of Crude

Tagged: crude, crude prices, Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.