Why DEF Demand Is Set to Increase and How to Plan Ahead

The diesel exhaust fluid (DEF) market is growing fast, and if you’re in the transportation industry or in any other industry running diesel equipment, this is something to keep on your radar. Jim Timmer, Vice President of DEF at Mansfield Energy, puts it simply: “The DEF market is shifting quickly as companies adapt to stricter regulations and better technologies.”

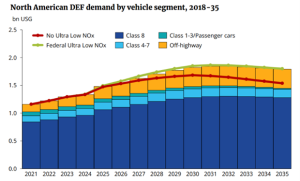

So, what’s driving this growth? It all comes down to tougher government rules aimed at cutting nitrogen oxide (NOx) emissions—a major contributor to air pollution. For diesel engines, meeting these standards relies heavily on Selective Catalytic Reduction (SCR) technology, which needs DEF to function. And the changes don’t stop there. The Environmental Protection Agency (EPA) is rolling out even stricter low-NOx regulations for the 2027 model year.

This means big adjustments. “Manufacturers will need to install additional SCR units and integrate features like cylinder deactivation to meet these new rules, which will significantly increase DEF usage,” Timmer explains. Whether you operate long-haul trucks, construction equipment, or anything in between, preparing for higher DEF demand is going to be key.

DEF Market

According to Argus Media Group, the global demand for Automotive Grade Urea (AGU) is projected to peak at 8.2 million metric tons, with an additional 800,000 metric tons expected for Marine Grade DEF (MGU) used in exhaust treatment. This brings the total peak demand for AGU and MGU to an estimated 9 million metric tons, equivalent to approximately 6 billion finished DEF gallons worldwide.

This growth is largely fueled by several key factors:

Emission Regulations – Governments worldwide are tightening standards for nitrogen oxide (NOx) emissions, requiring diesel engines to utilize Selective Catalytic Reduction (SCR) technology that depends on DEF. As regulations evolve, fleets must adapt to meet these new standards, especially with the Environmental Protection Agency (EPA) set to implement new low-NOx rules for the 2027 model year. These regulations will likely necessitate additional DEF usage, as most engine manufacturers will incorporate a second SCR unit along with cylinder deactivation to comply.

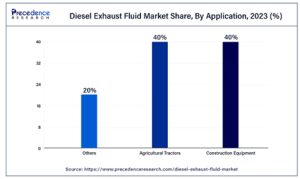

Industry Demand – The off-road and marine sectors are utilizing DEF as part of their operations, further supporting the expansion of DEF usage. “These industries are increasingly reliant on DEF as they upgrade their equipment to comply with new emissions standards,” Timmer noted. He pointed out that the strong economy and booming real estate market in the US have further fueled this trend. “As those industries expand, so does the use of diesel engines equipped with SCR systems.”

Infrastructure Growth – The number of DEF pumps is rising, improving access for fleet owners and operators. As the average age of vehicles continues to climb and the number of miles driven increases, the demand for DEF is expected to follow suit.

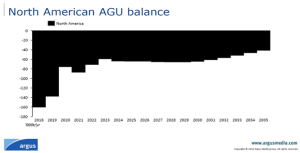

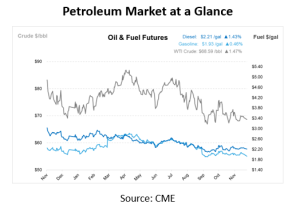

However, Timmer cautioned that the market faces several challenges. “We cannot overlook the rise of electric vehicles, which could potentially slow down DEF demand,” he said. Additionally, fluctuations in urea prices could pose a risk. “Currently, there are no new urea production facilities planned in the U.S., which is concerning.”

According to Argus Media, North American urea production is expected to fall short by 35 million gallons in 2025, impacting availability for DEF production. However, this shortage is being offset by current imports from Europe.

Mansfield Approach

To navigate these challenges, Mansfield Energy is making strategic investments in infrastructure and efficiency. “We’re adding DEF rail blending facilities that will receive 50% urea concentrate and blend it down to finished 32.5% urea, which will help optimize our supply chain,” Timmer explains. This collaboration with local partners aims to ensure timely deliveries to fleet owners, ultimately enhancing operational reliability.

Timmer also highlights the critical role of inventory management on fleet owners’ DEF storage equipment. “Accurate monitoring will help prevent shortages and ensure that fleet owners have the necessary DEF supply to meet their operational needs,” he notes.

“The landscape is changing rapidly, and those who adapt will be best positioned to thrive,” Timmer explains. With a combination of strategic investments and a proactive approach to regulatory compliance, the DEF market presents a promising opportunity for growth and innovation in the coming years.

Looking for High-Quality DEF for your Fleet? Look no further!

Mansfield Energy understands the importance of protecting your fleet assets. Today’s high-tech diesel engines are expensive. Using poor quality, off-spec DEF can increase fuel consumption, equipment downtime, and maintenance expenses. Mansfield ensures customers always have a reliable supply of high-quality DEF that consistently meets ISO standards.

With our extensive network of DEF distribution partners combined with our own dedicated assets, Mansfield offers unmatched DEF logistics to ensure you always have the DEF you need. Contact us today!

DEF Equipment Catalog

Looking for the right equipment for your DEF needs? With Mansfield’s DEF Equipment Catalog, you can explore a variety of DEF equipment options and request information or purchase support directly. Check out our online catalog today!

About Jim Timmer

Jim Timmer manages all aspects of Mansfield’s DEF business. With over two decades of experience in the fuel, lubricants, and logistics industry, Jim specializes in bringing innovative new solutions to the market.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.