Week in Review – Crude Climbs 4% on Geopolitics and Cold Snap

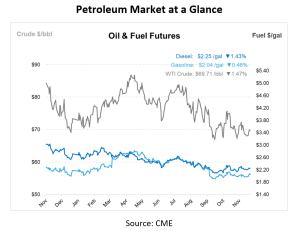

Oil prices are on track for a nearly 4% weekly gain as escalating tensions in Ukraine reignited geopolitical risk in oil markets. WTI crude edged lower this morning, dropping 66 cents to $69.71/bbl. The dip was influenced by weaker-than-expected eurozone business activity and manufacturing contraction. Despite this, crude prices gained over $2.50 per barrel for the week, with refinery margins and a cold snap pressuring prices. Rising tensions between Russia and Ukraine, including missile strikes and fears of potential damage to oil infrastructure, also added upward pressure.

Russian President Vladimir Putin announced on Thursday that Russia launched a hypersonic medium-range ballistic missile attack on Ukraine and warned of potential retaliation against the West for supplying Ukraine with long-range missiles. This follows Ukraine’s recent use of British Storm Shadow and U.S.-made missiles to strike deep into Russian territory, actions permitted by the U.K. and U.S. Additionally, President Biden approved the shipment of antipersonnel mines to Ukraine earlier this week.

These escalating geopolitical tensions overshadowed the impact of a stronger U.S. dollar, which climbed to a two-year high, making dollar-denominated crude more expensive for international buyers. The dollar index rose nearly 0.4% on Thursday.

China’s policy measures to boost trade and support energy imports have further buoyed oil prices, with crude imports expected to rebound in November. Meanwhile, Kazakhstan plans to increase oil production in 2025, with its Tengiz oilfield set to resume full production in December.

In October, U.S. monthly crude imports dropped 37% year-over-year to 335 kbpd, the lowest since April 2020, with November imports averaging 365 kbpd so far. Waterborne crude imports also fell 37% year-over-year in October. U.S. gasoline imports saw a significant decline, particularly from Europe, which fell to 137 kbpd—the lowest since May 2020—and Asia, which dropped 74% from the previous month to 21 kbpd. Gasoline imports to the U.S. Northeast from Europe reached their lowest levels since 2016, falling below 100 kbpd.

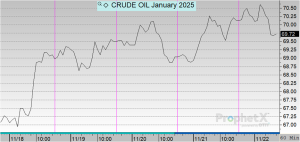

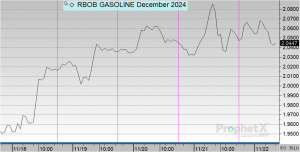

Prices in Review

Crude opened on Monday at $66.86 before beginning its upward trajectory for the week. This morning, crude opened at $70.18, its highest for the week, an overall increase of $3.32 or 4.96%.

On Monday, diesel opened at $2.1690 before spiking on Tuesday, trailing off a bit in Wednesday trading, and now on an upward trajectory. This morning, diesel opened at $2.2707, an overall increase of 10 cents or 4.68%.

Gasoline opened the week at $1.9453 and continued trading up for the rest of the week. This morning, gasoline opened at $2.0492, an increase of 10 cents or 5.34%.

This article is part of Daily Market News & Insights

Tagged: Daily Market News & Insights, diesel, fuel prices, gasoline, oil prices, wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.