Biden’s SPR Strategy Complete as Trump Signals Bold Oil Push

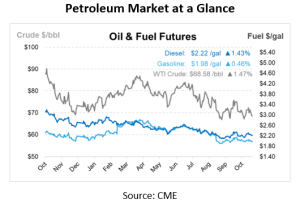

The Biden Administration has finalized its Strategic Petroleum Reserve (SPR) refill strategy, purchasing 2.4 million barrels of sour crude for April-May 2025 delivery. Meanwhile, oil prices have dipped since opening at $70.25 yesterday, with WTI now below $70 and Brent at $72 per barrel, amid weak inflation data, lackluster Chinese stimulus, and a strengthening U.S. dollar. OPEC’s reduced demand forecast has further pressured the market. ULSD and gasoline both dropped yesterday, pushing the crack spread up by 80 cents to around $24.26/bbl. The lack of strong economic stimulus from China was seen as bearish for crude oil demand.

In other energy policy shifts, President-Elect Donald Trump plans major energy policy shifts, including a likely withdrawal from the Paris climate agreement and removal of restrictions on U.S. drilling, mining, and LNG exports. This anticipated policy change has triggered a steep decline in clean energy stocks. Renewable energy developers are pausing projects, awaiting clarity on Trump’s policies, as analysts predict a potential 30% reduction in renewable growth if tax credits from the Inflation Reduction Act (IRA) are rolled back and tariffs are introduced on imported equipment.

In his first 100 days, Trump plans to prioritize U.S. oil and gas production by removing federal restrictions, aiming to make U.S. energy the lowest cost among industrial nations. This includes easing restrictions on drilling permits and LNG export approvals, which could drive down energy prices.

Trump also aims to broker a resolution to the Russia-Ukraine war by proposing a deal that allows Russia to retain certain territories while establishing a demilitarized zone, pushing NATO allies to increase defense spending. This could ease Europe’s energy pressures and potentially renew German interest in Russian energy imports.

Lastly, Trump is likely to support Israel’s efforts to counter Iran’s nuclear ambitions, strengthening U.S. influence in the Middle East, countering China, and fostering alliances with Arab states, particularly Saudi Arabia, to stabilize oil prices through U.S.-OPEC cooperation.

While on the subject of OPEC, their November 2024 report further reduced the global oil demand growth forecast for 2024 to 1.8 Mbpd, with most growth expected from non-OECD regions. This marks the fourth consecutive downward revision, down from the previous 1.93 Mbpd estimate. The 2025 demand growth forecast was also adjusted to 1.5 Mbpd, from 1.64 Mbpd. Non-OPEC supply is projected to grow by 1.2 Mbpd in 2024, primarily driven by the U.S. and Canada. In October, OPEC’s production increased by 0.21 Mbpd, while Kazakhstan and Iraq reduced output to better align with OPEC quotas, though Russia remained slightly above its agreed production limit.

This article is part of Daily Market News & Insights

Tagged: API, Biden, crude prices, Daily Market News & Insights, prices, Supply, Trump, U.S.

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.