Crude Futures Rise as Election Week, OPEC+, and a Hurricane Collide—What’s Next?

Today is US election day, and markets are bracing for potential volatility in response to the US presidential election results. Current polling shows a close race in key battleground states, which could lead to delayed results and uncertainty in the markets. Crude futures have risen in anticipation, as both candidates have vastly different outlooks on energy policy.

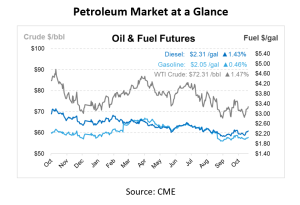

Crude oil futures rose nearly $1 this morning, with the December WTI opening at $71.62/bbl. Gasoline and diesel futures climbed around 5 cents on Monday and are up nearly 3 cents today. The gains followed OPEC+’s announcement to delay unwinding its 2022-2023 production cuts until January 1. Additionally, Iran pledged to increase oil output by 250,000 bpd.

A late-season tropical storm, Rafael, is forecasted to intensify into a Category 2 hurricane mid-week in the U.S. Gulf of Mexico, potentially disrupting up to 4 million barrels of U.S. oil production. Currently in the Caribbean, Rafael is expected to move through key oil-producing regions, with projected wind speeds of up to 100 mph by Wednesday, according to the National Hurricane Center.

Possible oil production losses between 3.1 and 4.9 million barrels are estimated. Some production facilities have started relocating non-essential personnel from offshore platforms, though routine production remains unaffected. Rafael is expected to have the second-largest impact on offshore production this year, following Hurricane Francine.

Meanwhile, diesel futures saw their fifth consecutive day of gains, with the December ULSD contract rising 4.99 cents to $2.2841/gal. Retail gasoline prices have dipped below $3.10/gal, with the most common pump price around $2.999/gal, marking a decline from May 2021 when the national average last fell below $3/gal.

Broader markets are experiencing momentum ahead of the U.S. presidential election, with equity futures up and the dollar down, sending crude prices higher. Escalating Middle Eastern tensions also contribute to upward pressure, as OPEC+ extends its output cuts into December 2024.

This week’s economic focus includes a widely expected 25 basis point rate cut from the Federal Reserve on Thursday, with similar cuts anticipated from the Bank of England and Riksbank. Additionally, China may introduce fiscal stimulus during its ongoing National People’s Congress.

Through a cap-and-trade system, the Canadian government has proposed draft legislation to cut emissions from the oil and gas industry by 35% by 2030 compared to 2019 levels. While oil and gas output is still predicted to rise by 16% from 2019 levels over the 2030–2032 period—just 1% lower than anticipated without the emissions cap—the government forecasts that these rules would result in a little 0.1% decline in the national GDP. The cap-and-trade strategy is intended to strike a compromise between economic stability and environmental objectives as Canada works to fulfill climate targets while permitting modest expansion in its fundamental energy industry.

This article is part of Crude

Tagged: Daily Market News & Insights, demand, diesel, gasoline, oil prices, opec, Supply, U.S.

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.