Diesel Nears 2-Year Low – Should You Lock in Your 2025 Budget?

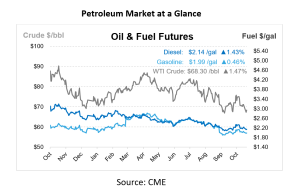

In September, diesel fuel prices fell to a 2-year low on economic concerns and a positive future outlook. Geopolitical strife caused prices to pop upwards, sending NYMEX diesel prices from $2.05 up as high as $2.40. Now, prices are once again falling towards the two-year low, offering an opportunity for businesses to lock in their 2025 fuel prices at levels we haven’t seen in years.

After months of volatility driven by geopolitical tensions, hurricanes, and economic factors, fuel prices have finally eased. For companies with heavy fuel consumption, locking in a fixed price while rates are relatively low provides a financial buffer against future fluctuations. By doing so, businesses can ensure stable operating costs, allowing for more predictable budgeting and reducing the risk of profit erosion.

Right now, ULSD diesel futures prices are sitting around $2.14, down 46 cents or 17.69% from July’s high of $2.60. According to AAA, the average retail price of diesel is $3.575, down roughly 90 cents from this time last year when diesel was averaging $4.47 at retail stations across the US. While diesel is not at the lowest it was in September, it is close, and these lows may be short lived.

No matter how much you plan ahead and prepare, markets can swing in a flip second and current low prices may not last. The day before Russia invaded Ukraine, no one could have known that prices would rise 50% within a matter of weeks. In December 2019, no one was talking about a pandemic that would obliterate markets the next year. No matter how many forecasts you read – you can’t know with certainty what prices will do next year. But you can know how much you’ll pay for fuel, if you choose to lock in your fuel budget.

The EIA’s projection of retail diesel prices at $3.50 per gallon in 2025 suggests a moderate increase, driven in part by potential supply constraints. Geopolitical factors, including OPEC+ production policies and recent events in the Middle East, mean that price increases are likely in the near term.

Fuel is a major expense for transportation-reliant companies, second only to labor costs. Locking in a fixed fuel price while prices are low provides cost predictability, reduces budget risks, and strengthens financial stability. Fixed pricing not only shields businesses from sudden price surges due to factors like severe weather or geopolitical events but also enhances competitive positioning by allowing companies to bid confidently on contracts with stable pricing.

In a volatile market, securing fixed fuel rates ensures budget consistency, supports reliable financial reporting, and boosts investor confidence. With the EIA forecasting higher diesel prices next year, locking in today’s rates offers a strategic hedge, supporting financial resilience and sustainability in an uncertain economic environment.

Mansfield Fuel Price Risk Management services support businesses in managing fuel price risks, helping them navigate unexpected fluctuations to safeguard their bottom line. Whether you want to lock in your bulk fuel volume, FOB rack commitments, or fleet card prices, Mansfield has solutions to control your fuel costs. Contact one of our experts today for a no-obligation quote, to see what your 2025 fuel price could be.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.