Week in Review – Pricing Tug of War with Middle East Uncertainty Meeting U.S. Demand Shifts

Oil prices dipped on Friday but were on track for a second consecutive weekly gain. Markets are balancing the potential impact of hurricane damage in the U.S. on demand with concerns over supply disruptions if Israel targets Iranian oil sites.

The possibility of Israeli strikes on Iranian oil infrastructure, which could tighten supply and add geopolitical risks, is causing some market volatility. Crude oil and refined product futures jumped on Thursday after a two-day decline as concerns over a potential Israeli strike on Iran heightened. This follows Israel’s consideration of a military response to Iran’s October 1 missile attacks, raising fears of supply disruptions in the Middle East. Andy Milton, Mansfield Energy’s SVP of Supply, describes the situation as a “pricing tug of war with Middle East tensions pulling the market higher, and economic and demand concerns pulling the market lower.”

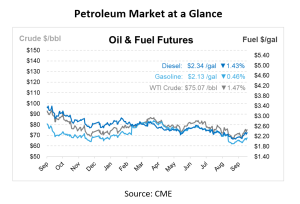

Yesterday, crude prices rose by about 3.6%, with November WTI increasing by $2.61 and December Brent gaining $2.82. Refined products also saw significant increases, with RBOB futures rising to $2.1509/gal and ULSD futures increasing to $2.3509/gal. These price gains followed strong U.S. gasoline and diesel demand last week, with the Energy Information Administration reporting the highest implied gasoline demand of the year at 9.654 Mbpd and strong distillate demand at 4.031 Mbpd. OPIS data showed a 2.8% increase in same-store sales volumes across the U.S., led by a 5.7% rise in the Southeast as Gulf Coast states prepared for Hurricane Milton and recovery from Hurricane Helene boosted demand, particularly in North Carolina.

Hurricane Milton’s destructive path through Florida, causing widespread power outages to homes, businesses, and fuel terminals, may dampen U.S. fuel demand. The Port of Tampa remained closed on Thursday following Milton’s landfall, while several other Gulf ports have started to reopen to vessel traffic.

In response to Hurricane Milton, at least seven cargoes of gasoline are en route to Florida’s deepwater ports, aiming to ensure fuel availability for all marketers, regardless of brand. An emergency order signed by Florida’s agricultural commissioner allows the purchase of branded and unbranded fuels interchangeably and could extend until December, enabling widespread fuel commingling for over 55 days. The cargoes are headed to Tampa and Port Everglades, but Tampa’s reopening remains uncertain due to potential debris in the port channels. The shipments originated from Texas, Louisiana, and Mississippi.

This week’s Department of Energy report highlighted that refinery utilization dropped below 87%, leading to a build-up in crude stocks and a drawdown in refined products, which is typical for this time of year due to planned refinery maintenance. Refinery utilization is anticipated to rise back to 90% by December as refiners prepare for winter diesel demand and begin focusing on gasoline for the spring driving season. Despite reduced production, diesel supply remains robust, with 2024 maintaining over 30 days of supply, in contrast to the supply challenges seen in 2022-2023.

Prices in Review

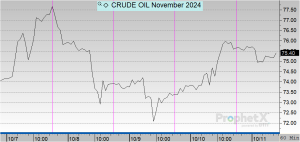

Crude opened on Monday at $74.40, increased sharply on Tuesday, and began tapering off the rest of the week. This morning, crude opened at $75.74, an overall increase of $1.34 or 1.8%.

Diesel opened the week at $2.3214 and increased on Tuesday before trailing off slightly throughout the week. This morning, diesel picked back up and opened at $2.3491, an increase of about 2 cents or 1.19%.

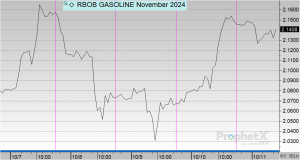

Gasoline opened the week at $2.096, jumped up on Tuesday, and fell back off the rest of the week. This morning, gasoline jumped again, opening at $2.1459, an increase of almost 5 cents or 2.38%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.