Hurricane Milton and Middle East Tensions: Double Trouble for Oil Markets

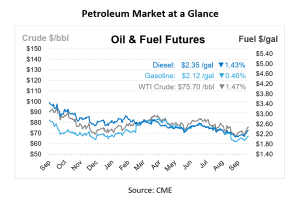

As Gulf Coast ports close and Israel weighs retaliation, global oil supply faces serious risks. Oil markets paused their rally this morning as they await Israel’s response to Iranian attacks from the previous week. Middle East conflict escalation has driven oil prices up, with Brent and WTI rising over 3% yesterday, building on last week’s 8% gain, the largest in over a year. This morning, Brent crude dropped off by 2%, and WTI dropped to $75/bbl.

The rally began after Iran’s missile attack on Israel on October 1, but the potential for Israeli retaliation against Iran’s oil facilities has yet to materialize. While oil prices could continue rising based on conflict perceptions, actual supply disruptions have not occurred. Some analysts believe an attack on Iranian oil infrastructure is unlikely and suggest a possible drop in oil prices if Israel targets other locations instead.

China’s economic outlook also weighed on the market, as investors were disappointed by the lack of stronger fiscal stimulus measures, adding to concerns about slower growth and fuel demand. Traders are also awaiting U.S. crude inventory data, which is expected to show an increase of 1.9 million barrels for the week.

Florida fuel markets are bracing for Hurricane Milton’s arrival between late Wednesday and early Thursday. Although Milton has weakened from a Category 5 to a Category 4 storm, it remains highly dangerous with 155 mph winds. According to the National Hurricane Center, Milton could become one of the most destructive hurricanes on record for the region, bringing damaging winds, life-threatening storm surges, and heavy rainfall extending beyond the forecasted path.

The storm is expected to shift northeast before making landfall on Florida’s west coast, with forecasts suggesting slight strengthening today followed by gradual weakening. However, the weakening will not lessen the storm’s severe impacts, including storm surges and destructive winds, which will affect a larger area as Milton grows in size.

The U.S. Coast Guard has restricted vessel navigation at multiple Florida ports. Although most U.S. Gulf Coast energy assets are outside the storm’s direct path, precautionary closures could lead to temporary supply disruptions.

Fuel carrier capacity is already constrained, with long lines at terminals and many drivers pulling off the roads to prepare for the storm. Additionally, evacuation traffic is complicating logistics, preventing fuel trucks from turning north after delivering to Tampa. By tomorrow, wind speeds exceeding 35 mph across Florida will halt fuel deliveries for safety reasons, lasting until Friday.

Stay Informed

Mansfield is closely tracking Hurricane Milton’s path to ensure businesses and customers in affected areas receive timely updates that may impact their operations. Backed by years of industry expertise, Mansfield’s Emergency Response Program is designed to ensure continuity during crises, employing best practices and a multi-tiered strategy that prioritizes critical services. By working closely with key partners, we aim to seamlessly maintain fuel distribution during emergencies.

For those in hurricane-prone regions, the challenges of severe storms are all too common. Along with power outages and flooding, securing fuel for vehicles and equipment becomes a significant issue, with shortages and long lines adding to the strain. Mansfield’s Emergency Response Fuel Program equips businesses with the resources to prepare effectively before a storm and ensures access to fuel in the aftermath. Discover more about our program, how to prepare, and what steps to take once the storm passes.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.