Oil Jumps 2% on China’s Aggressive Stimulus and Hurricane Worries

Oil prices have spiked this morning and are up over 2% on the rise of China’s monetary stimulus, escalating conflict in the Middle East, and the threat of another hurricane affecting Gulf of Mexico US oil production. China, the world’s largest oil importer, announced its largest economic stimulus since the COVID-19 pandemic, putting upward pressure on prices. Middle East tensions escalated as Israel launched airstrikes on Hezbollah sites in Lebanon, heightening concerns about potential regional supply disruptions.

U.S. oil producers are evacuating staff from Gulf of Mexico oil platforms in anticipation of a major hurricane, expected to hit later this week. The National Hurricane Center forecasts that a tropical cyclone in the Caribbean will intensify into a hurricane with winds up to 115 mph, potentially making landfall as a Category 3 storm. The storm, expected to be named Helene, poses risks of life-threatening storm surge and damaging winds, particularly to the northeastern Gulf Coast and Florida Panhandle.

China’s central bank has unveiled its most significant stimulus package since the pandemic to counter deflationary pressures and stimulate economic growth. The People’s Bank of China (PBOC) announced measures, including interest rate cuts, a 50-basis point reduction in reserve requirement ratios (RRR), and support for the struggling property market. These moves aim to restore confidence in the economy, but analysts believe that additional fiscal measures will be necessary to meet the government’s 5% growth target.

The package includes reduced borrowing costs, new funding for businesses, and mortgage relief for households. However, analysts express doubts about the effectiveness of these liquidity injections, noting weak credit demand and the ongoing property crisis, which has eroded consumer confidence. While the moves were well-received by financial markets, experts argue that China needs more aggressive fiscal policies to generate real economic demand.

Despite these efforts, challenges remain, especially in the property sector, where declining home prices and weak demand persist. Further stimulus may be required as China’s economy continues to face headwinds from a structural slowdown.

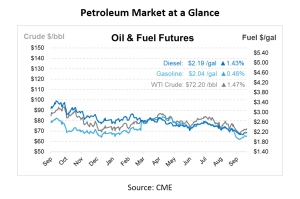

According to a Reuters report, U.S. oil prices may test support at $62.13 per barrel in the third quarter, and a break below this level could lead prices into the $46.35 to $54.24 range. A bearish wave C pattern is unfolding, with projections indicating a potential decline to this range. A confirmed bearish wedge suggests a target as low as $46. A pullback towards $71.89 is expected to end before the downtrend resumes. The market may revisit the recent low of $65.27, with a broader head-and-shoulders pattern pointing to a possible long-term target around $40. However, a break above $72.95 could alter the bearish outlook, pushing prices into the $75.16 to $78.73 range.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.