What’s That: Organization for Economic Co-operation and Development

Do you ever wonder how global policies are shaped and who provides the statistics and standards for them? In today’s What’s That Wednesday, we will explore the Organization for Economic Co-operation and Development (OECD), examining how their impact on global policies is made and what they do. At a glance, the OECD is a forum of knowledge and expertise aimed at creating better policies to help inform public policy debates with evidence-based analysis and standards. Let’s explore how the OECD influences global policy decisions and how their expertise brings together stakeholders to make progress on their standards.

What is the OECD?

Based in Paris, France, The Organization for Co-operation and Development (OECD) stands as an international organization that serves as a forum for making policy decisions. Their focus is on improving the well-being of people worldwide, providing a platform for governments to collaborate, share experiences, and find solutions to common challenges. The OECD works on understanding economic, social, and environmental changes, measuring productivity, and analyzing global trade and investment flows. It also sets international standards in various areas, including agriculture, tax, and chemical safety.

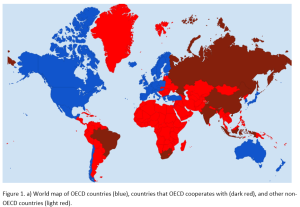

Working with over one hundred countries globally, the OECD aims to build stronger, more equipped, and cleaner societies by shaping better policies and contributing to improved lives. Countries within the OECD are often referred to as OECD countries, distinguished by their more developed economic infrastructure compared to non-OECD countries, which are often called developing or modernizing economies. The OECD consists of 38 member countries and six cooperating countries that are not official members. The non-OECD countries include those not directly involved with the organization.

OECD vs. Non-OECD Countries

Two key differences between OECD and non-OECD countries are the amount of primary energy consumed and population growth. OECD countries, which are generally wealthier, consume much more primary energy per capita. This is due to their advanced economies, greater industrial activity, higher levels of vehicle ownership, and extensive infrastructure that relies heavily on energy, including oil and gas. As a result, these countries have a deep demand for oil to fuel transportation, industry, and electricity generation. This difference in wealth can also be observed by comparing GDP between the two groups. Population growth is higher in non-OECD countries, including the BRIC nations (Brazil, Russia, India, and China). Only about one-sixth of the world’s population resides in OECD countries, which hold most of the wealth and account for the majority of energy consumption.

While non-OECD countries have lower per capita oil consumption, they are experiencing rapid growth in their demand for energy, including oil. This is driven by factors such as population growth, urbanization, and economic development. As these economies modernize, their oil consumption increases, often faster than in OECD countries.

OECD’s Influence on the Oil & Gas Industry

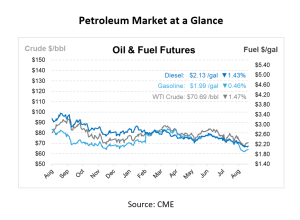

Due to their high consumption rates, the OECD countries are major global oil and gas market players. Their demand patterns influence global oil prices and production strategies. For instance, shifts in economic activity within OECD countries, such as a recession or technological advancements that improve energy efficiency, can lead to fluctuations in global oil demand.

The growing oil consumption in non-OECD countries, particularly large economies like China and India, reshapes the global oil market. While OECD countries still dominate in terms of consumption per capita, the sheer size and growth rate of non-OECD populations mean that their influence on global oil demand is increasing. The OECD’s policies and actions thus need to account for these shifts, balancing their own consumption patterns with the rising influence of non-OECD countries on global oil dynamics.

The OECD monitors and reports on global energy market trends, including shifts in energy demand, supply dynamics, and technological advancements. This information helps stakeholders anticipate changes in the energy landscape and adjust their strategies accordingly. Lastly, the OECD provides guidance on best practices for reducing the environmental impact of energy production and consumption. They offer recommendations for lowering greenhouse gas emissions, managing natural resources responsibly, and supporting the transition to renewable energy sources. The OECD also plays a role in aligning energy policies with climate goals by providing frameworks and tools for assessing the climate impact of energy systems and implementing strategies to reduce carbon footprints and enhance sustainability. Through these activities, the OECD contributes to the development of a more efficient, secure, and sustainable global energy economy.

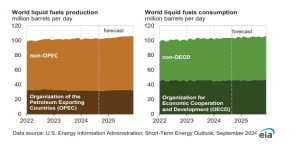

Understanding global liquid fuel consumption, which currently hovers around 90 to 100 million barrels per day, helps stakeholders understand how to forecast their fuel program. The OECD reports an annual consumption of 40 million barrels between 2022 and forecasts through 2025. With the changing landscape of liquid fuel consumption, analyzing these consumption patterns will help guide your fuel program strategies.

Risk management is another area where OECD fuels consumption trends can be beneficial. Awareness of global consumption trends helps manage risks associated with fluctuating oil prices and evolving market conditions. This insight enables more stable operations and better financial planning. For companies looking to navigate the evolving energy landscape, keeping track of these global and OECD liquid fuel consumption trends is key to informed decision-making and strategic positioning.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.