Week in Review – Francine Shakes Up Oil Markets: Will the Gains Hold?

Hurricane Francine came and went this week, causing disruption in the Gulf of Mexico, specifically in Louisiana. The storm temporarily shut down about 42% of oil production in the Gulf of Mexico, which accounts for 15% of US output. This has caused crude oil prices to rise by $1-2/bbl. Production is expected to resume shortly after inspections are completed for safety and environmental reasons, with some facilities already back up and running as of yesterday morning.

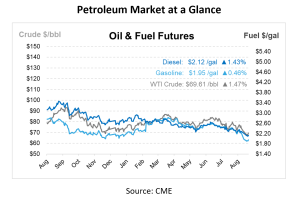

If current trends hold, both Brent and WTI crude benchmarks will break a streak of weekly declines. Brent crude, despite briefly dipping below $70 earlier this week, is on track for a 2.2% weekly gain, while WTI is set to rise by 3.1%. Price gains could continue due to a weaker U.S. dollar, which makes oil more affordable for buyers using other currencies.

Crude oil prices are overall alleviating, with further declines expected over the next six to nine months. Key factors driving this trend include reduced global demand forecasts from major organizations like the IEA, EIA, and OPEC, as well as weaker-than-expected demand from China. Increased oil production from non-OPEC countries, such as the U.S., Brazil, and Canada, has more than offset OPEC+ cuts, contributing to oversupply concerns. While short-term price rallies are possible due to low net long positions, they are likely to be brief. Even deeper production cuts by OPEC+ may not be enough to prevent an oil surplus in 2025.

Diesel prices are following a similar downward trend, driven by weaker demand and increased supply. The national average for diesel has dropped to $3.56 per gallon this week, the lowest level since October 2021. The EIA recently lowered its forecast for distillate fuel demand, which includes diesel, expecting a 2.3% decline from last year. Lowering the price of diesel, which is mostly used in production and transportation, is important because rising fuel costs have the potential to boost consumer prices for goods and reduce inflationary pressure.

A recent EIA report showed product builds and a slight decline in refinery utilization, which is expected to continue into early fall due to planned downtime. While hurricane-related refinery outages could cause some temporary dips, there’s no major concern about supply, with diesel days of supply remaining above 33 for nine months. In Europe, gasoil (diesel) inventories have spiked, reflecting lower demand that may reduce U.S. exports. This aligns with the current market softness. However, prices may not fall drastically, and future movements will depend on how lower interest rates impact the value of the dollar and commodities.

Prices in Review

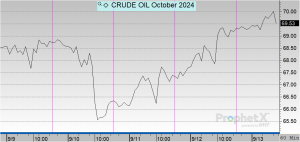

Crude opened the week at $68.13, jumped higher on Tuesday, trailed off the next two days and crept back up this morning. Today, crude opened at $69.31, an increase of $1.18 or 1.73%.

Diesel opened on Monday at $2.1315, jumping up on Tuesday before trailing off on Wednesday. This morning, diesel opened at $2.1241, an overall decrease of almost one cent or -0.35%.

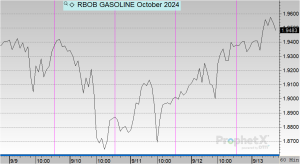

Gasoline opened the week at $1.9034, increased slightly on Tuesday, trailed off on Wednesday, and jumped back up on Thursday. This morning, gasoline opened at $1.9368, an increase of 3 cents or 1.75%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.