Oil Market Trends: Will Weak Demand Keep Prices in Check?

Recently, Mansfield Supply SVP Andy Milton shared market insights with industry leaders at the DeliveryONE Expo in Nashville, TN. During that presentation, he covered global supply and demand trends, as well as US fuel market insights. Below are some of the insights he shared.

From Russia’s invasion of Ukraine to dropping oil demand, global oil markets have seen their fair share of uncertainty. In 2022, a critical question facing the US oil market was: “Where is the supply?” Now, in 2024, the dynamics have shifted, with supply improving but demand showing signs of weakness, particularly from key markets like China. While the focus two years ago was on supply, the question now is: “Where is the demand?”

The Past: Where Markets Have Been

Over the years, the oil market has been hit by other pressures. Diesel futures saw historic backwardation, meaning spot prices were higher than future prices, signaling tight supplies. Inflation, driven in part by pandemic-related supply chain disruptions and energy costs, reached historic levels.

By the end of 2022, the US grappled with a market where demand remained strong, but supply was inadequate, causing oil prices to spike. The war and inflation combined to keep upward pressure on prices, creating one of the most volatile years in recent oil market history.

The Shift in 2024: Weak Demand, Strong Supply

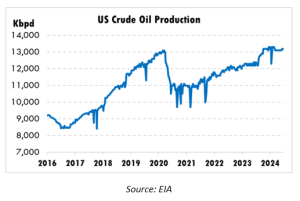

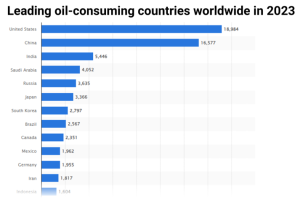

In 2024, the global oil market landscape has shifted. US crude oil production stands at 13.40 million barrels per day, up by 5.51% compared to 2023. However, the market is grappling with a different issue: weak demand. The post-pandemic rebound in China, one of the largest consumers of oil, has run its course, leading to a contraction in Chinese oil consumption.

Internationally, OPEC+ continues to monitor production levels carefully. After delaying production boosts in late 2023 due to deteriorating prices, OPEC+ is expected to gradually increase output starting in December 2024. The group aims to balance the market as it projects Brent crude prices to stabilize between $70 and $85 per barrel, reflecting the organization’s ongoing influence on the global oil supply.

On the demand side, world oil consumption continues to decelerate, with growth slowing to 710,000 barrels per day (kb/d) year-on-year in the second quarter of 2024—the slowest quarterly increase since late 2022.

In the US, the 2024 summer driving season has ended, causing a natural reduction in demand. The Energy Information Administration (EIA) reported that gasoline consumption in the last weeks of August resembled mid-October levels rather than late August. For only the third time in the past eight years, US gasoline inventories rose by 800,000 barrels, an uncommon occurrence for this time of year.

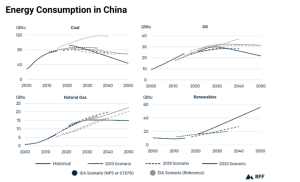

China, a key driver of global oil consumption, has also seen a slowdown in its economy, further weighing down global oil demand. This slowdown can be attributed to several factors, including aging demographics and China’s rapid adoption of electric vehicles, which has reduced demand for gasoline and diesel.

According to the International Energy Agency (IEA) forecast, global oil demand is expected to rise by less than 1 million barrels per day between 2024 and 2025. This sluggish growth can be attributed to subpar economic expansion, improved energy efficiencies, and the adoption of electric vehicles, which have significantly reduced the demand for gasoline and diesel.

Pricing Outlook

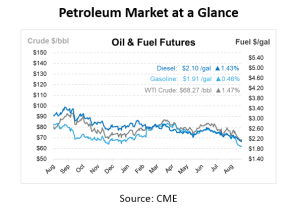

Regardless of the instability of the past few years, current oil prices in 2024 remain in the moderate range. Futures for Brent crude, the international oil benchmark, hovered around $80 per barrel—reaching the lowest price so far, at $71.51 per barrel, on September 9 (lowest since June 2023)—reflecting a relative calm in the market compared to 2022. In 2022, the lowest price was $75 per barrel in December, and the highest was $133 in June.

Historically, Brent crude’s inflation-adjusted price from 2010 to 2023 averaged $94.91 per barrel. As of Labor Day 2024, gasoline prices were 13% lower than in 2023, with the average price at $3.31 per gallon. For US consumers, this translates into some relief at the gas pump.

However, despite the current weak demand environment, crude oil prices are expected to rise during the second half of 2024. According to the EIA, prices will increase between $85 and $90 per barrel by 2024, driven by tightening global inventories and ongoing supply constraints from OPEC+.

While prices are expected to rise in the short term, the agency has revised its forecast for the average Brent crude oil price in 2025 downward to $88 per barrel. This adjustment reflects anticipated lower oil consumption next year, largely due to slowing economic growth in major markets such as China.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.