Oil Prices Slip Amid Middle East Tensions and Supply Uncertainty

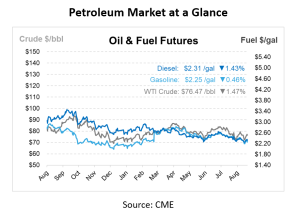

Oil prices experienced fluctuations on Tuesday, reflecting the ongoing turbulence in global energy markets. After rebounding more than 7% over the previous three sessions, driven by supply concerns and geopolitical risks, both Brent crude and West Texas Intermediate (WTI) saw declines. Brent crude futures were down 47 cents, or 0.58%, at $80.96 per barrel, while WTI dropped 54 cents, or 0.7%, to $76.88 per barrel. This dip comes after a surge fueled by fears of a widening conflict in the Middle East and potential shutdowns in Libya’s oil fields.

The recent rally in oil prices was primarily sparked by short-term supply disruptions. These disruptions were amplified by escalating tensions in the Middle East, where conflicts between Israel and Iran-backed Hezbollah have raised concerns about a broader regional conflict that could impact oil flows. Hezbollah’s recent announcement that it has concluded the “first phase” of its response to regional conflicts has done little to alleviate market fears. The possibility of further military action in the region, especially involving major oil-producing nations, remains a significant risk factor that could lead to further price volatility.

Libya’s production issues have also been a significant driver of the latest price movements. The country, which had been producing around 1.2 million barrels per day, has seen a sharp reduction in output due to political conflicts over control of its central bank. This has led to a halt in production at two oilfields in the southeast, with another field cutting its output. These developments have created immediate concerns about the availability of crude on the global market, leading to the price surge earlier in the week.

The broader market sentiment has turned bearish. Over the past seven weeks, hedge funds and other money managers have reduced their positions by a total of 346 million barrels, signaling a lack of confidence in the long-term outlook for oil prices. The positioning has been driven by concerns over weak demand growth, particularly from China, and expectations of increased output from OPEC and its allies in the coming months.

In addition to geopolitical risks, economic uncertainty in the United States and other major economies is adding to the market’s bearish outlook. Although U.S. job growth has been relatively strong, with an average of 170,000 new jobs per month over the last three months, there are concerns that these figures may be overstated. A potential slowdown in economic activity could dampen oil demand further, putting additional downward pressure on prices.

In response to these shifting market dynamics, Goldman Sachs Research (GIR) has made significant revisions to its Brent crude price forecasts. The investment bank has lowered its Brent price range by $5 per barrel, now expecting prices to range between $70 and $85 per barrel. This downward adjustment reflects several key factors that have emerged in recent months. GIR’s analysts also lowered their 2025 average Brent forecast to $77 per barrel, down from $82, citing higher-than-expected OECD inventories and a lower fair value estimate for crude.

Goldman Sachs also highlighted the potential for OPEC to increase production in the fourth quarter of 2024. The bank believes that OPEC, which has previously played a role in supporting spot balances and reducing market volatility, may shift its focus to strategically disciplining non-OPEC supply. This shift could lead to a more long-term strategy aimed at maintaining cohesion within the alliance and ensuring that its members can sustainably manage production levels.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.