Week in Review: Refinery Outages Push Gas Prices Higher after Days of Declines

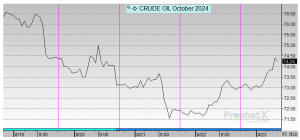

After four days of declines, oil prices are up this morning over $1.20/bbl, pressured by a larger-than-expected draw in U.S. fuel inventories, which limited further decreases. Brent crude edged up by 0.5% yesterday, and WTI increased by 0.3%. Despite this, oil prices continue to face downward pressure due to concerns over global demand, particularly regarding China’s economic slowdown and potential weakness in the U.S. economy.

Earlier in the week, oil prices dropped significantly, with Brent falling 4% and WTI losing 5.8%, driven by concerns over U.S. jobs data revisions and weak economic indicators from China. These factors have led analysts to predict that oil demand growth may fall below expectations.

However, the U.S. crude draw provided upward pressure on prices, and investors are closely watching OPEC+ actions. There is speculation that the group might reconsider its plans to increase supply in October. Concerns over how these production decisions will impact the market, alongside geopolitical tensions, are adding to the uncertainty in oil prices.

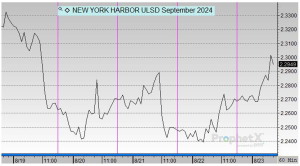

This week, diesel exports hit an all-time high, driven by robust refinery output and lower domestic demand. Despite domestic diesel demand trailing behind last year’s levels, refineries continue to operate at high capacity, with the latest data showing utilization at 92.3%. This sustained production has contributed to six consecutive weeks of over 34 days of diesel fuel supply, making the export market increasingly attractive for U.S. refiners.

Looking ahead, planned refinery downtime, particularly in the Midwest and Ohio regions, is expected to begin next month. This downtime could temporarily alleviate the current supply glut. However, the market’s balance will ultimately depend on winter demand levels against the backdrop of elevated supply. The situation warrants close monitoring as these factors could significantly influence diesel prices and supply availability in the coming months.

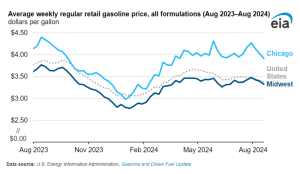

A series of refinery outages in the Midwest, specifically in Chicago and Ohio, have increased regional gasoline prices, bringing them closer to the U.S. average. The outages during the peak summer demand season reduced refinery activity and drew down gasoline inventories.

As a result, Midwest refinery utilization dropped by 11 percentage points, causing a decrease in gasoline production and a subsequent dip in regional gasoline inventories. This supply reduction pushed Midwest gasoline prices closer to the national average, a rare occurrence, especially in Chicago, where prices jumped to 20% above the U.S. average for several weeks. Although the refineries have since resumed operations, regional inventories remain below average, maintaining upward pressure on prices.

Prices in Review

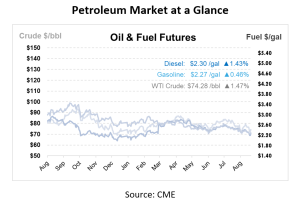

Crude opened the week at $76.58 and trailed off for most of the week. This morning, crude opened at $72.58, a decrease of 4 cents or -5.2%.

Diesel opened the week at $2.3263, and saw marginal up and down swings all week. This morning, diesel opened at $2.2677, an overall decrease of almost 6 cents or -2.52%.

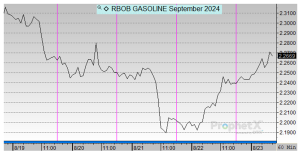

Gasoline opened the week at $2.3163 and trended similarly to crude, with marginal decreases throughout the week. This morning, gasoline opened at $2.2395, a decrease of almost 8 cents or -3.3%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.