Oil Prices Ease After 5-Day Gain Streak as Markets Eye the Middle East and US Inflation

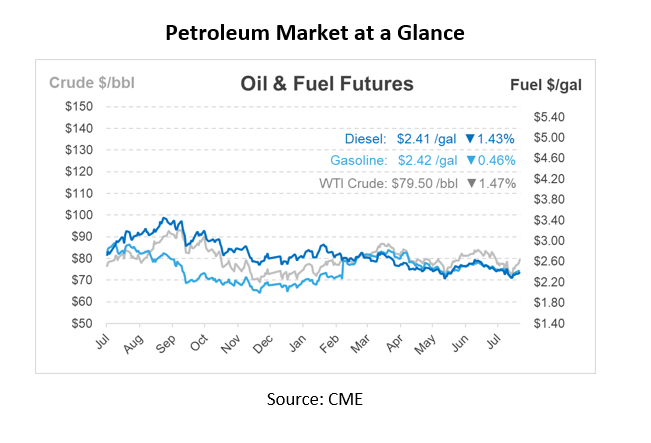

Oil prices are easing off this morning after five consecutive days of increases and rising more than 4% or $2.80/bbl yesterday. Markets are awaiting Iran’s reaction to Israel’s killing of a Hamas leader in Tehran last week, as well as the US CPI report that will be released tomorrow pointing to the future of inflation. WTI and Brent are currently up $1.75/bbl and $1.20/bbl month to date. The WTI September-October spread finished with the biggest backwardation since October 2023, indicating evidence of strength in the front of the curve.

Financial markets anticipate that the Federal Reserve may begin easing interest rates in September. With inflation slowing and the labor market cooling, cheaper services have offset the rise in goods costs, signaling continued moderation in inflation. The Fed has kept its benchmark interest rate in the 5.25%-5.50% range for the past year, following significant rate hikes in 2022 and 2023.

The IEA published its August monthly report this morning. Due to modest forecasts for demand growth in China, the group reduced its projection for oil demand growth in 2025 by 30,000 bpd to 950,000 bpd and kept its demand growth prediction for 2024 untouched at 970,000 bpd. The group raised its estimate for 2025 oil supply to 104.9 Mbpd from 104.89 Mbpd but dropped its projection for total oil output in 2024 from 103 Mbpd to 102.9 Mbpd. According to the organization, Saudi Arabia and Iraq led the increase in OPEC’s oil output in July, which increased by 250,000 bpd month over month to 27.34 Mbpd. According to the IEA, demand outside the OECD’s leading economies was at its lowest point since 2020.

On Monday, OPEC reduced its 2024 oil demand forecast for the first time since July 2023, partly due to concerns about China. Despite the downward revision, OPEC still expects global oil demand to increase by 2.11 Mbpd this year, much higher than the IEA’s forecast of a 970,000 bpd increase.

Concerns about Middle Eastern oil supplies revolve around potential future developments with retaliation from Iran. There are immediate fears of an Iranian attack on Israel, yet the more pressing matter for third-quarter oil prices could be Israel’s potential retaliation. If Israel targets Iran’s oil infrastructure, particularly the Kharg Island oil export terminal, it could disrupt crude supply balances later in 2024. An attack may also compel the US to impose sanctions on Iranian oil exports, potentially impacting the supply of up to 1.5 Mbpd.

This article is part of Daily Market News & Insights

Tagged: crude, crude prices, Daily Market News & Insights, demand, IEA, opec, wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.