Oil Prices Swing on Middle East Tensions and Recession Fears

Oil prices are volatile this morning, initially rising due to concerns over potential supply disruptions from escalating Middle East tensions. Gains were limited by weak demand expectations in China and a broader market recovery following Monday’s sell-off. Despite early session gains due to supply disruption fears, the negative sentiment from weak U.S. job growth data and China’s economic signals could sustain the downtrend in crude oil futures. On Monday, concerns over a U.S. recession led to a 1% drop in both benchmarks, affecting global stock markets. Additionally, fears of a wider regional conflict grew after potential Iranian retaliation threats against Israel and the U.S. following high-profile assassinations and military attacks.

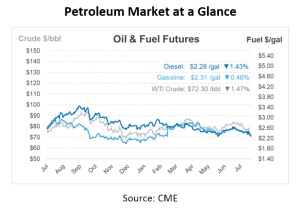

Benchmarks for crude oil ended particularly above their midday lows yesterday despite the initial decline. The NYMEX September WTI contract finished at $72.94/bbl, down 58 cents, after falling as low as $71.67/bbl in the morning. After tumbling as low as $75.05/bbl, the October Brent contract closed 51 cents down at $76.30/bbl. Following reports of a potential Iranian strike on Israel within 48 hours, both benchmarks saw a jump in price of 85–90 c/bbl in overnight trade.

U.S. recession fears are primarily driven by a weak July payrolls report, which indicated slower job growth. This report heightened concerns about the overall economic health and added to existing worries about weak oil demand from China. Investors reacted by speculating that significant interest rate cuts would be necessary to stimulate economic growth. This market sentiment contributed to a stock market selloff, which in turn pressured oil prices.

Recession fears could lead to lower oil prices as economic slowdown typically reduces oil demand. Additionally, oil markets are facing pressure from increased OPEC+ production, and the group plans to phase out voluntary output cuts starting in October. Despite these factors, oil losses were somewhat mitigated by geopolitical risks in the Middle East, where ongoing conflicts and potential escalations could disrupt crude supplies.

Chicago Federal Reserve Bank President Austan Goolsbee addressed recession fears yesterday, noting that while the recent U.S. employment data was weaker than expected, it does not indicate a recession. He emphasized that the Federal Reserve must remain vigilant and responsive to changing economic conditions to avoid being overly restrictive with interest rates. He stated that all options, including rate cuts, are on the table if economic conditions deteriorate.

Revisions to official U.S. oil consumption data have caused concern among market participants. Traders and analysts closely watch the weekly and monthly supply and demand data from the U.S. Department of Energy’s statistical arm, the U.S. Energy Information Administration (EIA). These figures influence billions of dollars in energy flows and policy decisions, including OPEC+ production levels.

Recently, the EIA published a monthly update showing U.S. oil consumption at a seasonal record in May, with gasoline use surpassing pre-pandemic levels. This data conflicted with weekly updates from the same period, which indicated that oil and fuel demand was struggling to match last year’s levels. Typically, monthly data, released with a two-month lag, may differ from weekly data by 100,000 to 200,000 bpd, which is a marginal change in a market consuming 20 Mbpd. However, recent revisions have shown significant discrepancies.

May’s weekly data suggested U.S. gasoline consumption was just over 9 Mbpd, slightly lower than the previous year. Traders interpreted this as a sign that electric vehicles, hybrids, and more efficient engines were reducing fuel use. In contrast, the monthly update showed gasoline consumption nearly 400,000 bpd higher than weekly estimates, exceeding 2019 levels despite higher fuel costs. This revision indicated U.S. oil demand in May at a seasonal record of 20.8 Mbpd, 800,000 bpd higher than weekly estimates.

The EIA explained that the weekly figures for May were inaccurate due to overestimated gasoline output and undercounted exports. While the agency does not expect weekly estimates to be as precise as monthly data, it aims to show consistent trends. The EIA is working to better align its weekly and monthly data and has made several adjustments to improve the accuracy of its petroleum market reflections.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.