Week in Review: OPEC Sticks to Targets as Oil Prices Dip for Fourth Consecutive Week

Oil prices are on track for a fourth weekly decline, hovering at $74/bbl as indications of weak global fuel demand outweigh concerns over potential supply disruptions in the Middle East. Recent killings of senior leaders from Iran-aligned militant groups Hamas and Hezbollah have raised fears of a potential all-out war in the region, which could threaten oil supplies.

In their recent meeting, OPEC and allied producers maintained their oil production targets but indicated they might raise output based on market conditions. They reiterated plans to increase production by 540,000 bpd in the fourth quarter of 2024. Russian oil companies have slowed their drilling activities in 2024 to comply with OPEC’s production cuts but may ramp up in the fourth quarter. Russia’s oil firms drilled 14,370 kilometers of production wells in the first half of 2024, a 2.5% decrease from the previous year. Russia is adhering to two OPEC+ production cuts: a 500,000 bpd reduction from last year and a 471,000 bpd cut for June to September. Russia’s production will stay at 8.978 Mbpd until it begins to phase out cuts in the fourth quarter of 2024.

China’s demand for diesel is projected to decline by approximately 2% in the second half of 2024 to 3.93 Mbpd, following a contraction in the country’s oil consumption in the second quarter, leading refiners to reduce fuel production and crude oil imports.

In May, U.S. oil demand reached a seasonal record, with total crude oil and petroleum product supply increasing by 792,000 bpd to 20.8 Mbpd, the highest for May on record. This jump was driven by gasoline consumption hitting 9.4 Mbpd, the most since August 2019, marking a significant turnaround from earlier EIA estimates of around 20 Mbpd. This, in turn, suggests higher projections for U.S. oil demand growth. U.S. crude oil production, however, fell by 61,000 bpd to 13.18 Mbpd in May, the first decline since January due to lower output from the Gulf of Mexico and North Dakota despite record production in Texas and New Mexico.

In west Texas, three earthquakes struck a sparsely populated area on Monday, including a magnitude 4.9 quake, marking over 100 earthquakes in nine days—a rare event for the region. Experts are linking the increased seismic activity to oil and gas extraction methods, specifically hydraulic fracturing (shale fracking) and enhanced oil recovery (EOR). These techniques involve injecting large quantities of water and chemicals into the earth, releasing oil and highly salty water, which is disposed of in deep wells. The Texas oil regulator has already idled two such wells.

Regulatory bodies, like the Railroad Commission of Texas, face the challenge of managing the environmental impact of these technologies. Carbon capture and storage (CCS) is being explored as a way to mitigate CO2 emissions while enhancing oil recovery. Studies suggest that EOR could significantly extend the lifespan of oil fields, with the U.S. Department of Energy researching new methods to optimize CO2-EOR for broader application.

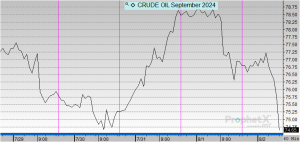

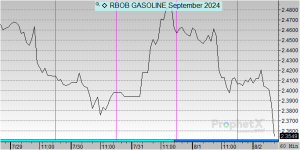

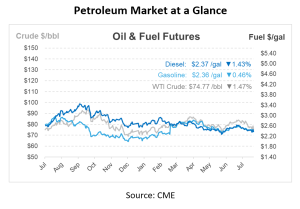

Prices in Review

Crude opened the week at $77.30 and saw two days of decreases before spiking back up on Thursday. This morning, crude opened at $76.87, a decrease of 43 cents or -0.56%.

Diesel opened the week at $2.43 and also saw two days of decreases before jumping back up on Thursday. This morning, diesel opened at $2.4238, an overall decrease of nearly 1 cent or -0.255%.

Gasoline opened on Monday at $2.4565, following similar patterns to crude and diesel. This morning, gasoline opened at $2.4102, a drop of 4 cents or -1.88%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.